Question: You are a hedge fund manager and need to create a portfolio that will hopefully outperform the stock market. The expected return and risk of

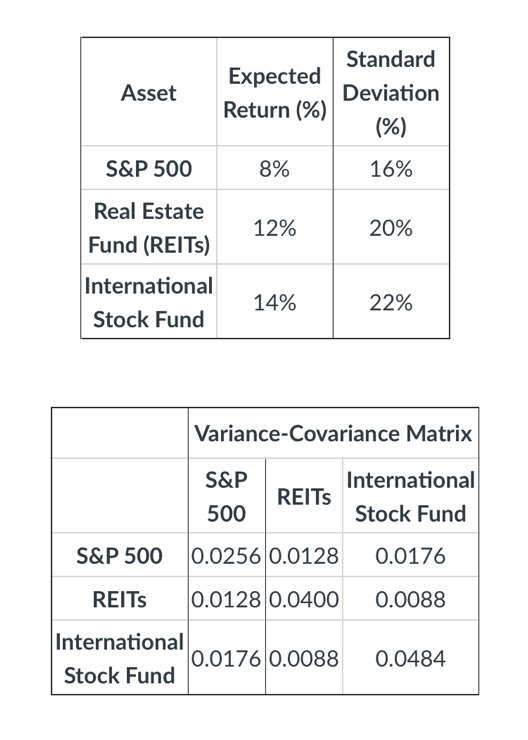

You are a hedge fund manager and need to create a portfolio that will hopefully outperform the stock market. The expected return and risk of your potential choices are:

Note that the Variance-Covariance matrix tells you the variance and covariance of S&P500, REITs, and International Stock Fund. The variances are the diagonal elements and the covariances are the off-diagonal elements. For instance, the variance of REITs is 0.0400 and the covariance of S&P500 and International Stock Fund is 0.0176.

The risk-free rate over this period is 3%. All given rates are annual rates.

a) If you choose to hold 25% of your wealth in the S&P 500, 50% in REITs, and the rest in the international stock fund, what is the expected return of your portfolio?

d) If the actual annual returns of your portfolio over the last 10 years was 15%. Compared to your expected portfolio return calculation from part (a), what is the alpha of your portfolio?

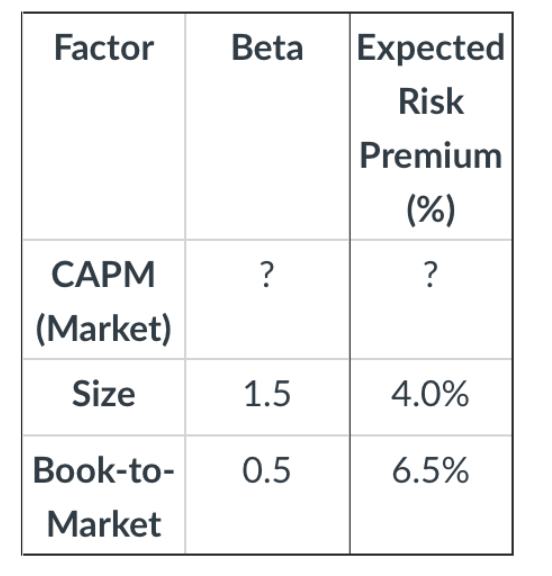

e) Now you are having doubts as to whether the CAPM is the right asset pricing model for your portfolio and now thinking about using an alternative model, such as the APT, because your portfolio is exposed to more risk factors than you thought. The betas to the risk factors and expected risk premium are:

What is your portfolio's expected returns using APT? What is the portfolio's alpha with respect to APT?

Asset Expected Return (%) Standard Deviation (%) S&P 500 8% 16% Real Estate Fund (REITs) 12% 20% International Stock Fund 14% 22% Variance-Covariance Matrix S&P REITS International Stock Fund 500 S&P 500 0.0256 0.0128 0.0176 REITS 0.0128 0.0400 0.0088 International 0.0176 0.0088 Stock Fund 0.0484 Factor Beta Expected Risk Premium (%) ? ? CAPM (Market) Size 1.5 4.0% 0.5 6.5% Book-to- Market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts