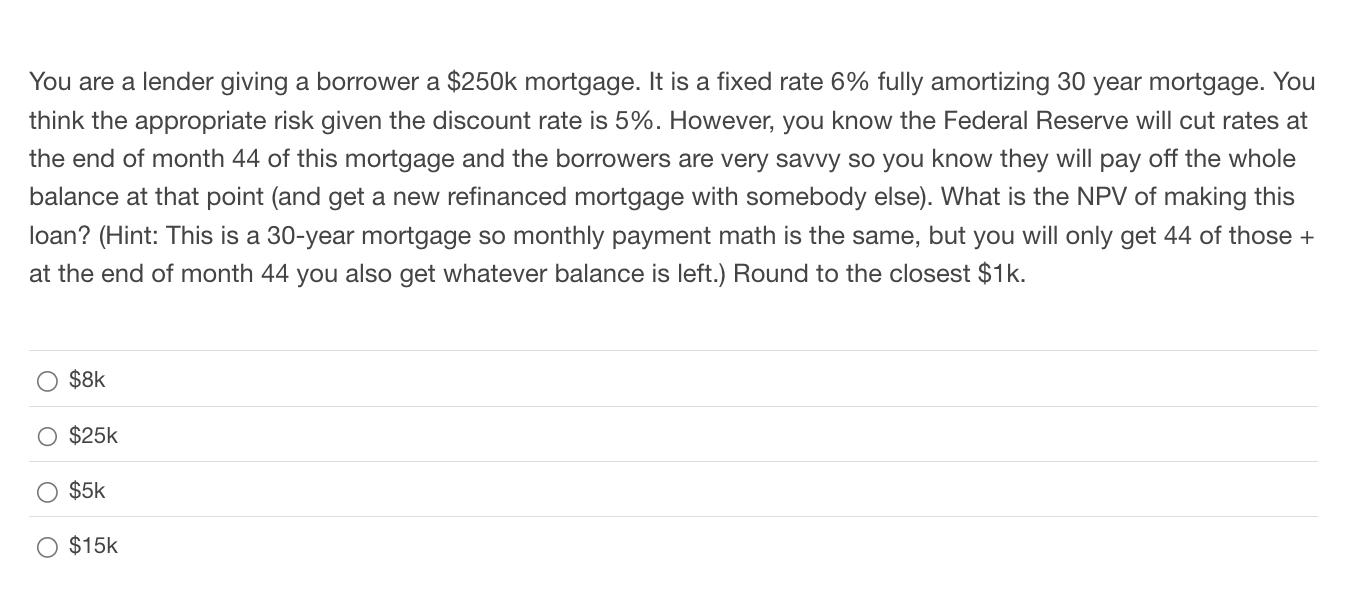

Question: You are a lender giving a borrower a $ 2 5 0 k mortgage. It is a fixed rate 6 % fully amortizing 3 0

You are a lender giving a borrower a $ mortgage. It is a fixed rate fully amortizing year mortgage. You think the appropriate risk given the discount rate is However, you know the Federal Reserve will cut rates at the end of month of this mortgage and the borrowers are very savvy so you know they will pay off the whole balance at that point and get a new refinanced mortgage with somebody else What is the NPV of making this loan? Hint: This is a year mortgage so monthly payment math is the same, but you will only get of those at the end of month you also get whatever balance is left. Round to the closest $

$k

$k

$

$k

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock