Question: You are adding a machine to an existing factory that costs $4 million (this is both an investment and a loan). - Years 1-4

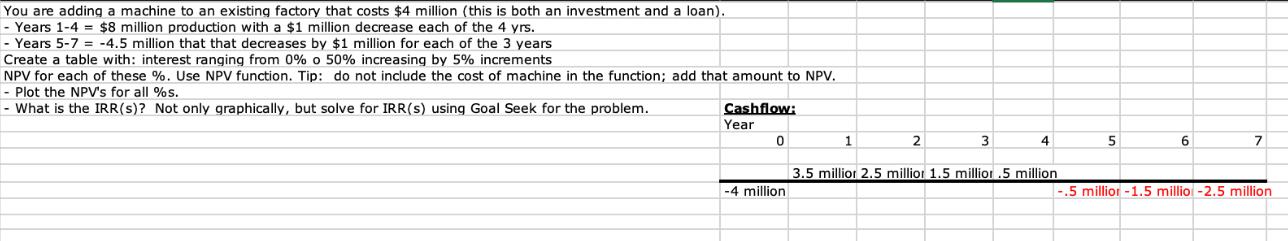

You are adding a machine to an existing factory that costs $4 million (this is both an investment and a loan). - Years 1-4 $8 million production with a $1 million decrease each of the 4 yrs. - Years 5-7 = -4.5 million that that decreases by $1 million for each of the 3 years Create a table with: interest ranging from 0% o 50% increasing by 5% increments NPV for each of these %. Use NPV function. Tip: do not include the cost of machine in the function; add that amount to NPV. - Plot the NPV's for all %s. - What is the IRR (s)? Not only graphically, but solve for IRR(S) using Goal Seek for the problem. Cashflow: Year 0 -4 million 1 2 3 4 3.5 millior 2.5 millior 1.5 million .5 million 5 6 7 -.5 millior -1.5 millio -2.5 million

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

To calculate the Net Present Value NPV at different interest rates and determine the Internal Rate o... View full answer

Get step-by-step solutions from verified subject matter experts