Question: You are an accountant and Nigel is your client. Write an internal memorandum to your senior manager explaining how capital gains tax would operate

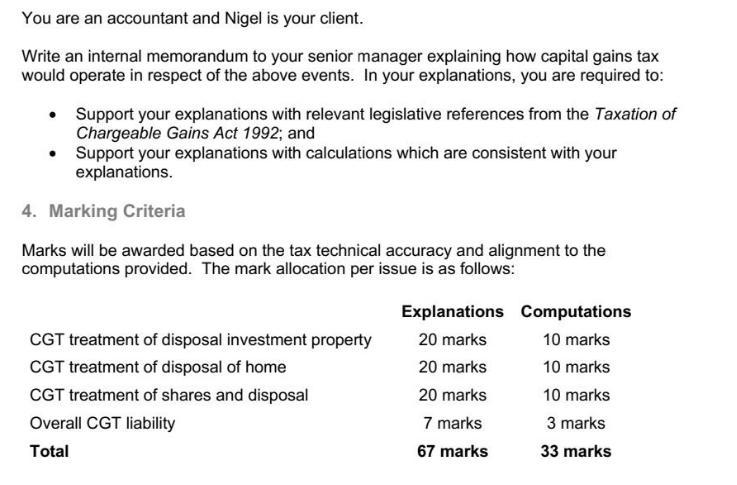

You are an accountant and Nigel is your client. Write an internal memorandum to your senior manager explaining how capital gains tax would operate in respect of the above events. In your explanations, you are required to: Support your explanations with relevant legislative references from the Taxation of Chargeable Gains Act 1992; and Support your explanations with calculations which are consistent with your explanations. 4. Marking Criteria Marks will be awarded based on the tax technical accuracy and alignment to the computations provided. The mark allocation per issue is as follows: CGT treatment of disposal investment property CGT treatment of disposal of home CGT treatment of shares and disposal Overall CGT liability Total Explanations 20 marks 20 marks 20 marks 7 marks 67 marks Computations 10 marks 10 marks 10 marks 3 marks 33 marks

Step by Step Solution

There are 3 Steps involved in it

Internal Memorandum To Senior Manager From Faith Rachael Date 17012024 Subject Capital Gains Tax Analysis for Nigel I am writing to provide an analysi... View full answer

Get step-by-step solutions from verified subject matter experts