Question: You are an associate in the Annapolis Based private equity firm of Dewey, Cheatem & Howe. The managing partner has asked you to do a

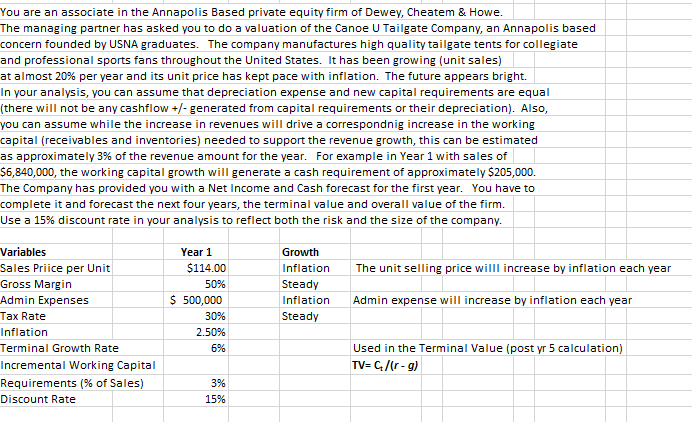

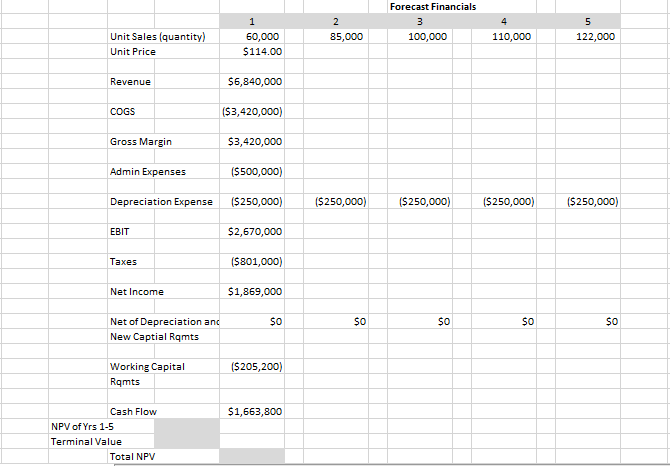

You are an associate in the Annapolis Based private equity firm of Dewey, Cheatem & Howe. The managing partner has asked you to do a valuation of the Canoe U Tailgate Company, an Annapolis based concern founded by USNA graduates. The company manufactures high quality tailgate tents for collegiate and professional sports fans throughout the United States. It has been growing (unit sales) at almost 20% per year and its unit price has kept pace with inflation. The future appears bright. In your analysis, you can assume that depreciation expense and new capital requirements are equal (there will not be any cashflow t-generated from capital requirements or their depreciation). Also, you can assume while the increase in revenues will drive a correspondnig increase in the working capital (receivables and inventories) needed to support the revenue growth, this can be estimated as approximately 3% of the revenue amount for the year. For example in Year 1 with sales of $6,840,000, the working capital growth will generate a cash requirement of approximately $205,000. The Company has provided you with a Net Income and Cash forecast for the first year. You have to complete it and forecast the next four years, the terminal value and overall value of the firm. Use a 15% discount rate in your analysis to reflect both the risk and the size of the company. Variables Sales Priice per Unit Gross Margin Admin Expenses Tax Rate Inflation Terminal Growth Rate Incremental Working Capital Requirements (% of Sales) Discount Rate Year 1 $114.00 50% 500,000 30% 2.50% 6% Growth Inflation The unit selling price willl increase by inflation each year Steady Inflation Admin expense will increase by inflation each year Steady $ Used in the Terminal Value (post yr 5 calculation) TV G/(r-g) 3% 15% Forecast Financials Unit Sales (quantity) Unit Price 60,000 $114.00 85,000 100,000 110,000 122,000 Revenue $6,840,000 (S3,420,000) $3,420,000 $500,000) preciation Exese S250,000) $2,670,000 ($801,000) $1,869,000 So COGS Gross Margin Admin Expenses ($250,000) ($250,000) ($250,000) ($250,000) EBIT Taxes Net Income Net of Depreciation a New Captial Rqmts So So So So $205,200) Working Capital Rqmts Cash Flow $1,663,800 NPV of Yrs 1-5 Terminal Value Total NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts