Question: You are analyzing two mutually exclusive projects using IRR. Project A has an IRR of 8.75% and Project B has an IRR of 9.12%. If

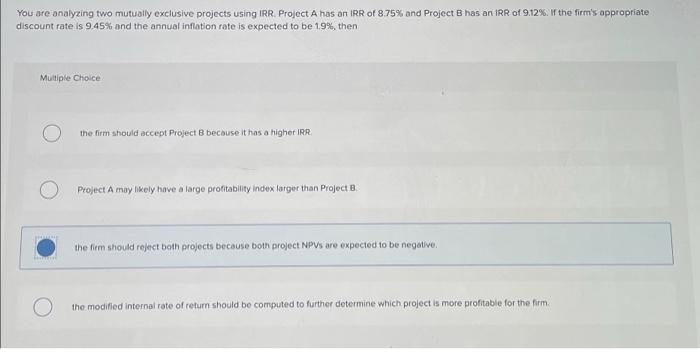

You are analyzing two mutually exclusive projects using IRR. Project A has an IRR of 8.75% and Project B has an IRR of 9.12%. If the firm's appropriate discount rate is 9.45% and the annual inflation rate is expected to be 1.9% , then Multiple Choice - Hamal the firm should accept Project B because it has a higher IRR Project A may likely have a large profitability index larger than Project B. the firm should reject both projects because both project NPVS are expected to be negative. the modified internal rate of return should be computed to further determine which project is more profitable for the firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts