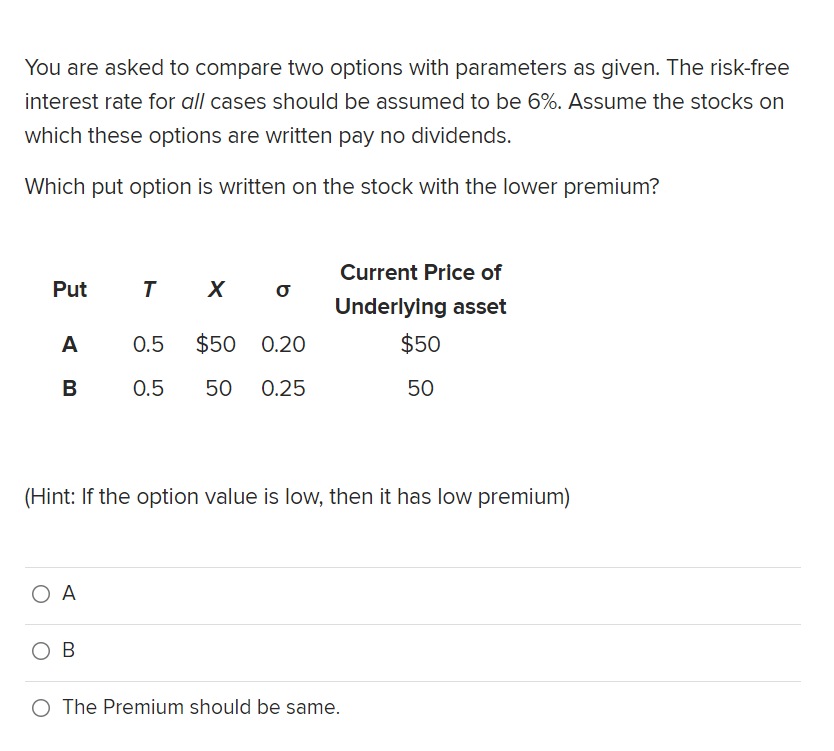

Question: You are asked to compare two options with parameters as given. The risk-free interest rate for all cases should be assumed to be 6%. Assume

You are asked to compare two options with parameters as given. The risk-free interest rate for all cases should be assumed to be 6%. Assume the stocks on which these options are written pay no dividends. Which put option is written on the stock with the lower premium? Put TX Current Price of Underlying asset $50 A 0.5 $50 0.20 B 0.5 50 0.25 50 (Hint: If the option value is low, then it has low premium) OB O The Premium should be same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts