Question: You are asked to develop a multivariate time series based forecasting model to forecast the daily returns of a stock. You have taken 5 exogenous

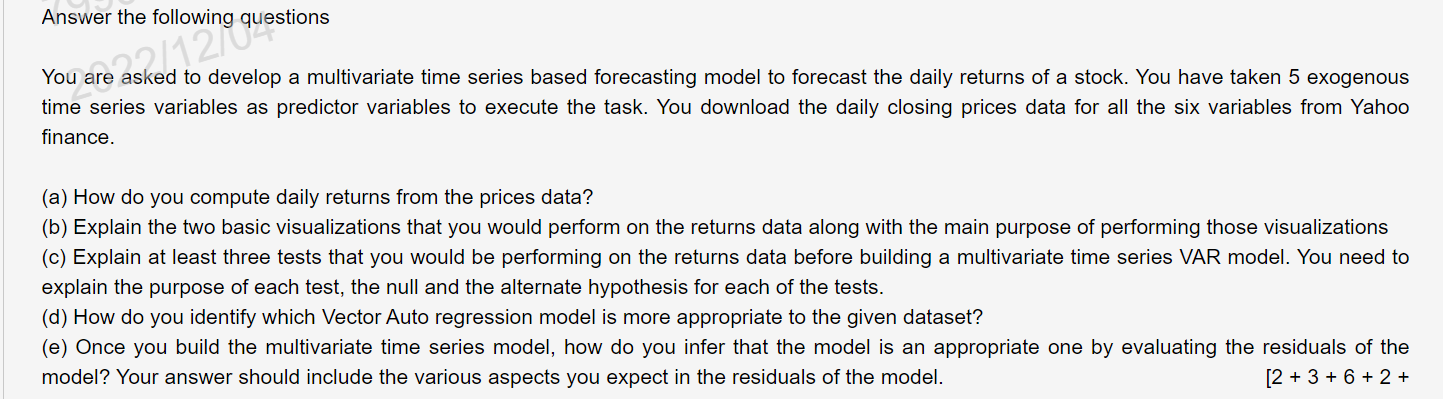

You are asked to develop a multivariate time series based forecasting model to forecast the daily returns of a stock. You have taken 5 exogenous time series variables as predictor variables to execute the task. You download the daily closing prices data for all the six variables from Yahoo finance. (a) How do you compute daily returns from the prices data? (b) Explain the two basic visualizations that you would perform on the returns data along with the main purpose of performing those visualizations (c) Explain at least three tests that you would be performing on the returns data before building a multivariate time series VAR model. You need to explain the purpose of each test, the null and the alternate hypothesis for each of the tests. (d) How do you identify which Vector Auto regression model is more appropriate to the given dataset? (e) Once you build the multivariate time series model, how do you infer that the model is an appropriate one by evaluating the residuals of the model? Your answer should include the various aspects you expect in the residuals of the model. [2+3+6+2+ You are asked to develop a multivariate time series based forecasting model to forecast the daily returns of a stock. You have taken 5 exogenous time series variables as predictor variables to execute the task. You download the daily closing prices data for all the six variables from Yahoo finance. (a) How do you compute daily returns from the prices data? (b) Explain the two basic visualizations that you would perform on the returns data along with the main purpose of performing those visualizations (c) Explain at least three tests that you would be performing on the returns data before building a multivariate time series VAR model. You need to explain the purpose of each test, the null and the alternate hypothesis for each of the tests. (d) How do you identify which Vector Auto regression model is more appropriate to the given dataset? (e) Once you build the multivariate time series model, how do you infer that the model is an appropriate one by evaluating the residuals of the model? Your answer should include the various aspects you expect in the residuals of the model. [2+3+6+2+

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts