Question: You are asked to evaluate a project which requires the purchase of an asset and you must determine the break-even level of the cost of

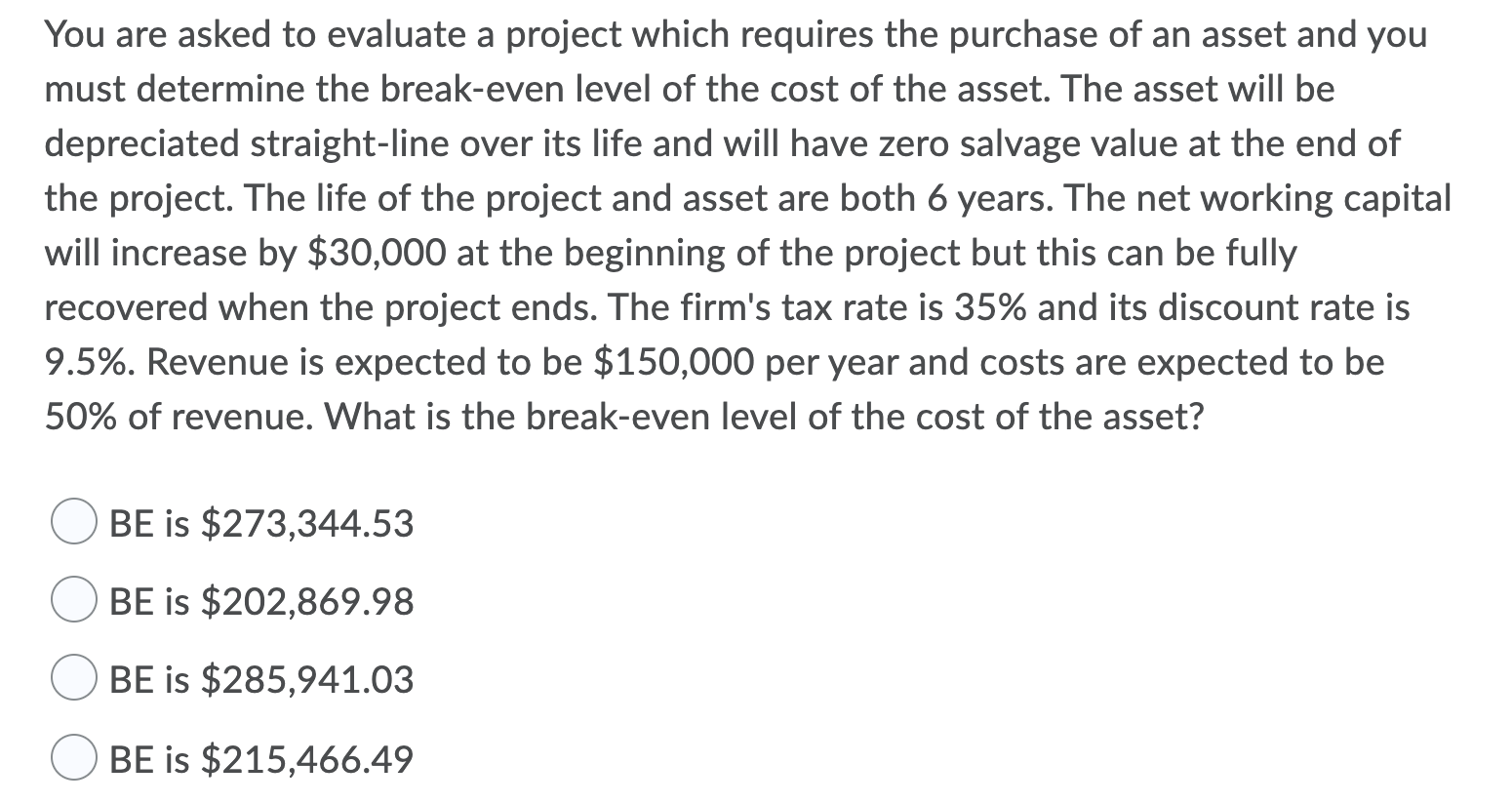

You are asked to evaluate a project which requires the purchase of an asset and you must determine the break-even level of the cost of the asset. The asset will be depreciated straight-line over its life and will have zero salvage value at the end of the project. The life of the project and asset are both 6 years. The net working capital will increase by $30,000 at the beginning of the project but this can be fully recovered when the project ends. The firm's tax rate is 35% and its discount rate is 9.5%. Revenue is expected to be $150,000 per year and costs are expected to be 50% of revenue. What is the break-even level of the cost of the asset? BE is $273,344.53 BE is $202,869.98 BE is $285,941.03 BE is $215,466.49

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts