Question: You are asked to evaluate the following two projects for Adventures Club, Inc.: PROJECT D ( Trips to Disneyland ) PROJECT F ( International Film

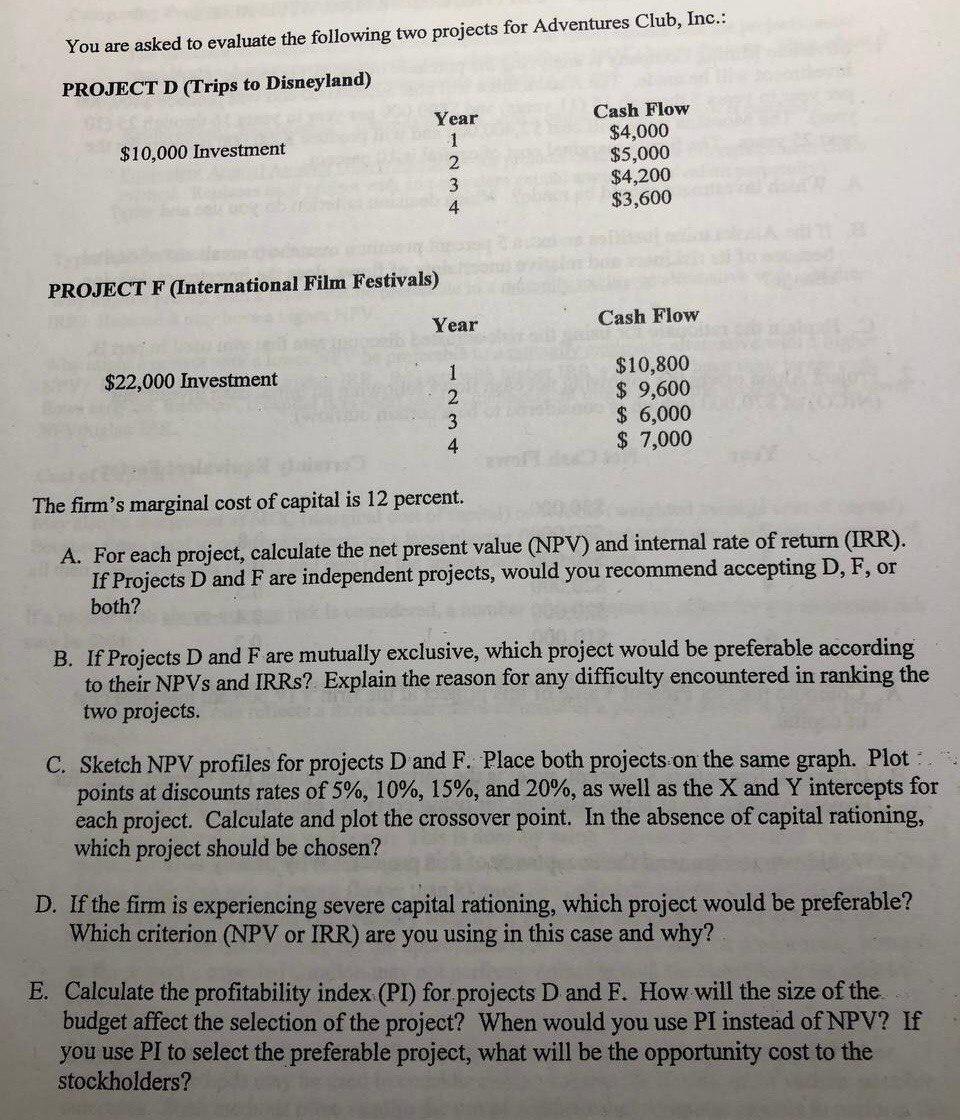

You are asked to evaluate the following two projects for Adventures Club, Inc.:

PROJECT D Trips to Disneyland

PROJECT F International Film Festivals

The firm's marginal cost of capital is percent.

A For each project, calculate the net present value NPV and internal rate of return IRR

If Projects D and F are independent projects, would you recommend accepting DF or both?

B If Projects D and F are mutually exclusive, which project would be preferable according to their NPVS and IRRs? Explain the reason for any difficulty encountered in ranking the two projects.

C Sketch NPV profiles for projects D and F Place both projects on the same graph. Plot points at discounts rates of and as well as the X and Y intercepts for each project. Calculate and plot the crossover point. In the absence of capital rationing,

which project should be chosen?

D If the firm is experiencing severe capital rationing, which project would be preferable? Which criterion NPV or IRR are you using in this case and why?

E Calculate the profitability index PI for projects D and F How will the size of the budget affect the selection of the project? When would you use PI instead of NPV If you use PI to select the preferable project, what will be the opportunity cost to the stockholders?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock