Question: YOU ARE AWESOME! Question 9 2 pts Consider a 2% coupon bond with 2 years to maturity and a face value of $100. Assume the

YOU ARE AWESOME!

YOU ARE AWESOME!

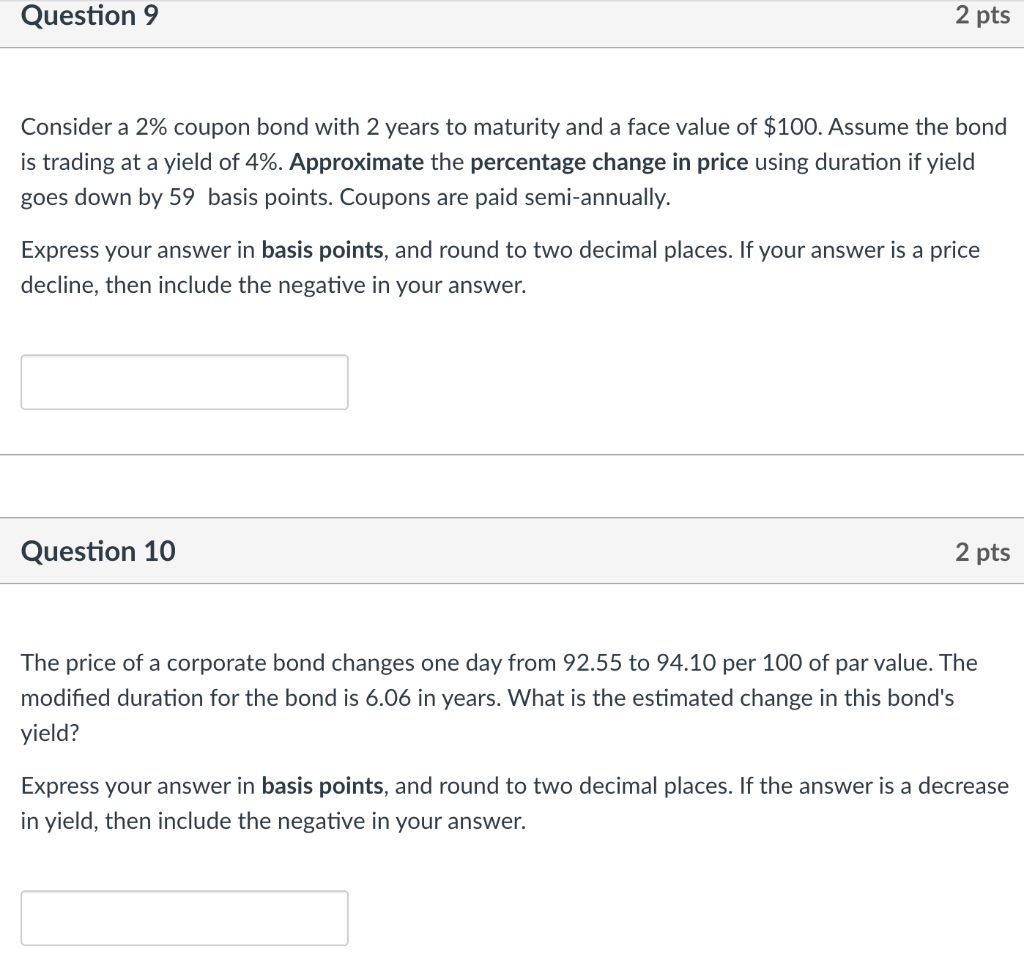

Question 9 2 pts Consider a 2% coupon bond with 2 years to maturity and a face value of $100. Assume the bond is trading at a yield of 4%. Approximate the percentage change in price using duration if yield goes down by 59 basis points. Coupons are paid semi-annually. Express your answer in basis points, and round to two decimal places. If your answer is a price decline, then include the negative in your answer. Question 10 2 pts The price of a corporate bond changes one day from 92.55 to 94.10 per 100 of par value. The modified duration for the bond is 6.06 in years. What is the estimated change in this bond's yield? Express your answer in basis points, and round to two decimal places. If the answer is a decrease in yield, then include the negative in your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts