You are borrowing $250,000 to buy a house, using a standard, 30-year mortgage. Your mortgage lender...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

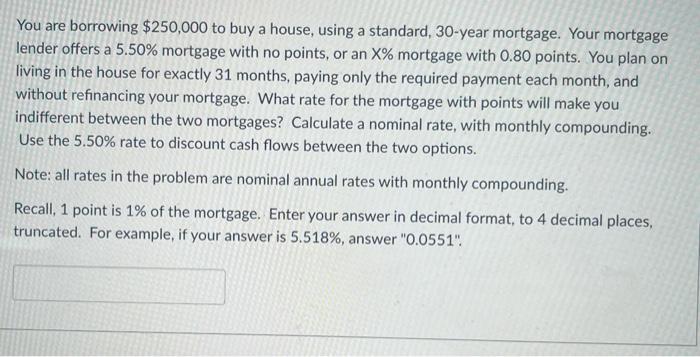

You are borrowing $250,000 to buy a house, using a standard, 30-year mortgage. Your mortgage lender offers a 5.50% mortgage with no points, or an X% mortgage with 0.80 points. You plan on living in the house for exactly 31 months, paying only the required payment each month, and without refinancing your mortgage. What rate for the mortgage with points will make you indifferent between the two mortgages? Calculate a nominal rate, with monthly compounding. Use the 5.50% rate to discount cash flows between the two options. Note: all rates in the problem are nominal annual rates with monthly compounding. Recall, 1 point is 1% of the mortgage. Enter your answer in decimal format, to 4 decimal places, truncated. For example, if your answer is 5.518%, answer "0.0551". You are borrowing $250,000 to buy a house, using a standard, 30-year mortgage. Your mortgage lender offers a 5.50% mortgage with no points, or an X% mortgage with 0.80 points. You plan on living in the house for exactly 31 months, paying only the required payment each month, and without refinancing your mortgage. What rate for the mortgage with points will make you indifferent between the two mortgages? Calculate a nominal rate, with monthly compounding. Use the 5.50% rate to discount cash flows between the two options. Note: all rates in the problem are nominal annual rates with monthly compounding. Recall, 1 point is 1% of the mortgage. Enter your answer in decimal format, to 4 decimal places, truncated. For example, if your answer is 5.518%, answer "0.0551".

Expert Answer:

Related Book For

Posted Date:

Students also viewed these accounting questions

-

A young couple decides to save to buy a house in 5 years, whose value on that date will be $25,000. They will make quarterly deposits in equal installments, starting in 3 months. The bank recognizes...

-

You want to buy a house that costs $100,000. You have $10,000 for a down payment, but your credit is such that mortgage companies will not lend you the required $90,000. However, the realtor...

-

You want to buy a house for which the owner is asking $625,000. The only problem is that the house is leased to someone else with five years remaining on the lease. However, you like the house and...

-

Evaluate each expression if possible. (-3)4

-

What does preprocessing involve in FF processes? What does postprocessing involve?

-

Coast Property Management was started on November 1 by Jeanne Daly to provide managerial services for the owners of apartment buildings. The organizational period extended throughout November and...

-

Describe how learning cycles can be used to identify project risks. AppendixLO1

-

Describe the channel of distribution for a craft beer from Belgium to your city or town. How many channel levels will be involved? Brewing craft beer is both an art and a science, and Sonia Collin, a...

-

Below are three independent and unrelated errors. a. On December 31, 2015, Wolfe-Bache Corporation failed to accrue office supplies expense of $2,300. In January 2016, when it received the bill from...

-

Surkis Company acquires equipment at a cost of $42,000 on January 3, 2017. Management estimates the equipment will have a residual value of $6,000 at the end of its four-year useful life. Assume the...

-

Pharoah Company uses the FIFO cost formula in a perpetual inventory system. Fill in the missing amounts in the following perpetual inventory record: (Round cost per unit to 2 decimal places, eg....

-

Lennys Limousine Service (LLS) is considering the purchase of two Hummer limousines. Various information about the proposed investment follows: Required: Help LLS evaluate this project by calculating...

-

Lancer Corp. has the following information available about a potential capital investment Required: 1. Calculate the projects net present value. 2. Without making any calculations, determine whether...

-

Woodchuck Corp. is considering the possibility of outsourcing the production of upholstered chair pads included with some of its wooden chairs. The company has received a bid from Padalong Co. to...

-

Woodchuck Corp. is considering eliminating a product from its line of outdoor tables. Two products, the Oak-A and Fiesta tables, have impressive sales. However, sales for the Studio model have been...

-

Suppose that Flyaway Company also produces the Windy model fan, which currently has a net loss of \($40,000\) as follows: Eliminating the Windy product line would eliminate \($20,000\) of direct...

-

Bismarck and Altoona exchange buildings. The transaction has commercial substance. The following information was obtained: Cost Accumulated Depreciation Fair value based upon appraisal Bismarck's...

-

Using the information in P11-2B, compute the overhead controllable variance and the overhead volume variance. Data From Problem 11-2B: Huang Company uses a standard cost accounting system to account...

-

Outdoor Amenities is a manufacturer of backyard and deck furniture. Its products are in high demand, and it carries no inventory. Following is a list of selected account balances from its trial...

-

The Green Giraffe Restaurant Group has 21 restaurants scattered across the midwestern portion of the United States. Green Giraffe is not publicly held, but is owned by a small group of investors. For...

-

Caesars Palace Las Vegas made headlines when it undertook a $75 million renovation. In mid-September 2015, the hotel closed its then-named Roman Tower, which was last updated in 2001, and started a...

-

The efficient market hypothesis suggests that it is difficult to outperform the market on a consistent basis. Are there possible exceptions to the hypothesis that concern the valuation of common...

-

How might a Daily Spending Diary result in wiser consumer buying and more saving for the future?

-

Jamie Lee sat down with a salesperson to discuss a new vehicle and its $24,000 purchase price. Jamie Lee has heard that no one really pays the vehicle sticker price. What guidelines may be suggested...

Study smarter with the SolutionInn App