Question: You are buying a new computer-aided drafting and design system for your business that costs $100,000 today. To use this system fully, you must invest

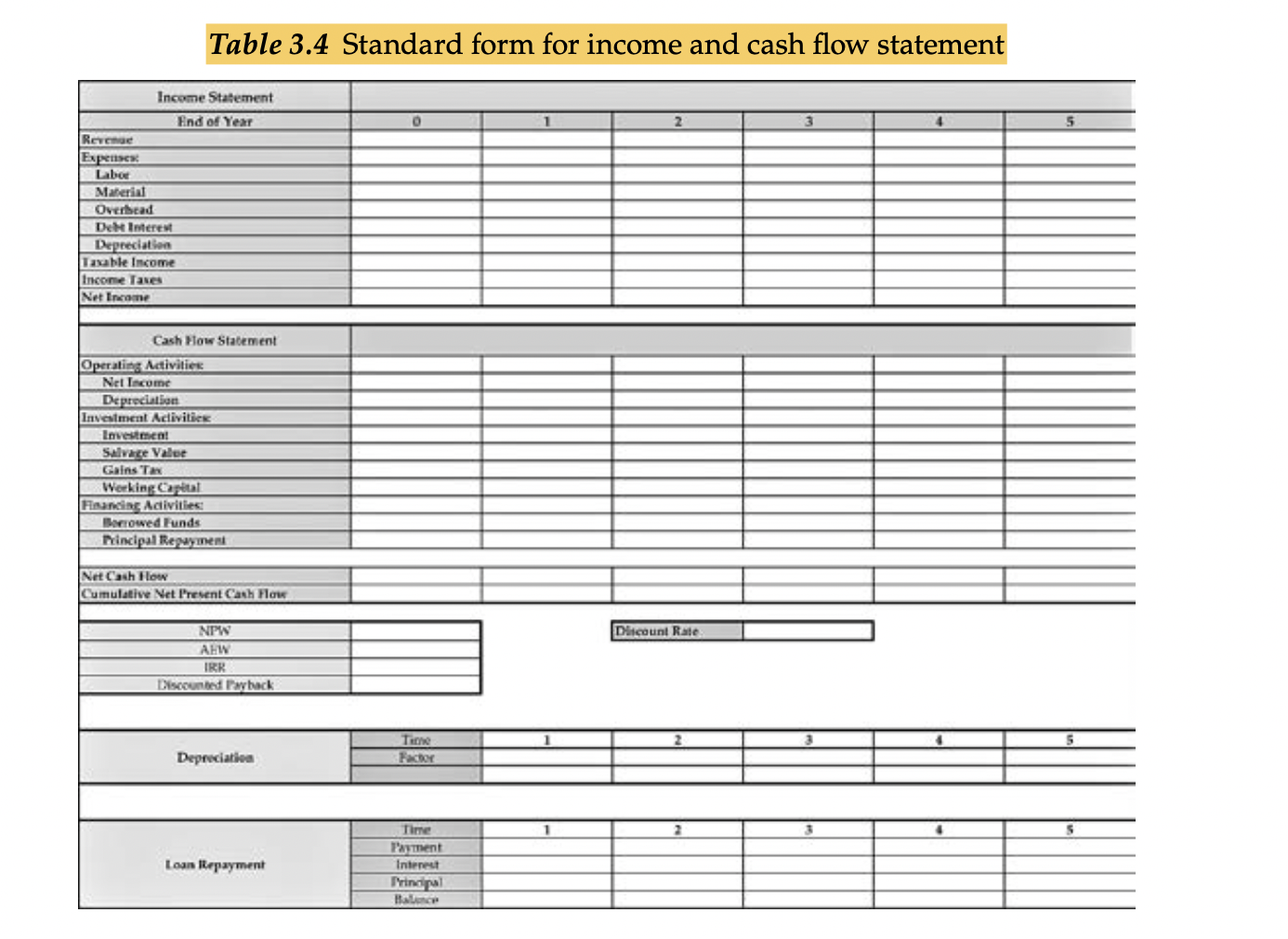

You are buying a new computer-aided drafting and design system for your business that costs $100,000 today. To use this system fully, you must invest an additional $25,000 in training costs. You finance $80,000 of the total investment cost at an effective annual interest rate of 8%, payable in five annual payments. The manufacturer has guaranteed you a salvage value of $20,000 for the system at the end of 5 years. The incremental cash flows generated with this system include $80,000 in annual revenues and $20,000 in annual non-capital expenses. Your MARR is 12%. Use the 7 years MACRS tax depreciation and a marginal tax rate of 39%. Use the template provided in Table 3.4 as a starting point for your income/cash flow statement. Table 3.4 Standard form for income and cash flow statement You are buying a new computer-aided drafting and design system for your business that costs $100,000 today. To use this system fully, you must invest an additional $25,000 in training costs. You finance $80,000 of the total investment cost at an effective annual interest rate of 8%, payable in five annual payments. The manufacturer has guaranteed you a salvage value of $20,000 for the system at the end of 5 years. The incremental cash flows generated with this system include $80,000 in annual revenues and $20,000 in annual non-capital expenses. Your MARR is 12%. Use the 7 years MACRS tax depreciation and a marginal tax rate of 39%. Use the template provided in Table 3.4 as a starting point for your income/cash flow statement. Table 3.4 Standard form for income and cash flow statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts