Question: You are choosing between a project from Luthor Corp. and a similar one from Kent Corp. Both projects have the same NPV. However, you noticed

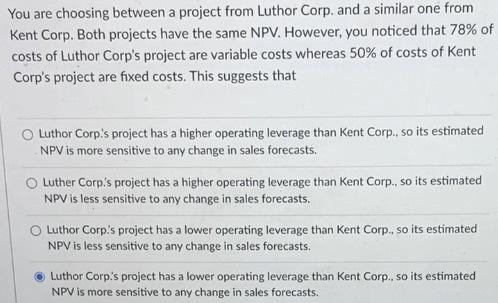

You are choosing between a project from Luthor Corp. and a similar one from Kent Corp. Both projects have the same NPV. However, you noticed that 78% of costs of Luthor Corp's project are variable costs whereas 50% of costs of Kent Corp's project are fixed costs. This suggests that Luthor Corp's project has a higher operating leverage than Kent Corp. so its estimated NPV is more sensitive to any change in sales forecasts. O Luther Corp's project has a higher operating leverage than Kent Corp. so its estimated NPV is less sensitive to any change in sales forecasts. Luthor Corp's project has a lower operating leverage than Kent Corp. so its estimated NPV is less sensitive to any change in sales forecasts. Luthor Corp's project has a lower operating leverage than Kent Corp., so its estimated NPV is more sensitive to any change in sales forecasts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts