Question: You are comparing two call options. a) Assume that the two options are on the same underlying stock and everything else about them is the

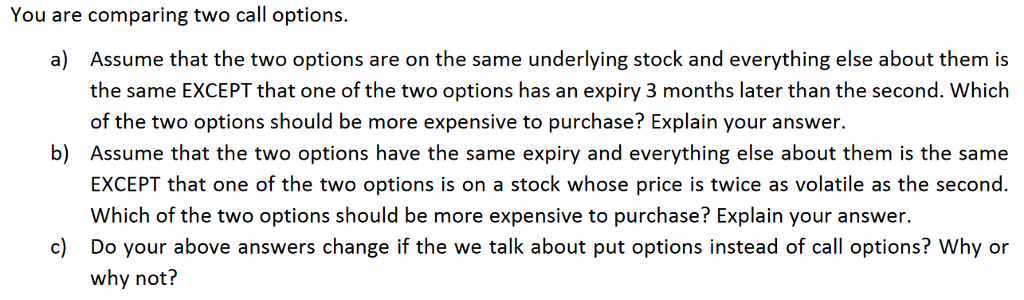

You are comparing two call options. a) Assume that the two options are on the same underlying stock and everything else about them is the same EXCEPT that one of the two options has an expiry 3 months later than the second. Which of the two options should be more expensive to purchase? Explain your answer. Assume that the two options have the same expiry and everything else about them is the same EXCEPT that one of the two options is on a stock whose price is twice as volatile as the second Which of the two options should be more expensive to purchase? Explain your answer Do your above answers change if the we talk about put options instead of call options? Why or why not? b) c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts