Question: You are considering 2 bonds that will be issued tomorrow. Both are rated triple B (BBB, the lowest investment-grade rating), both mature in 20

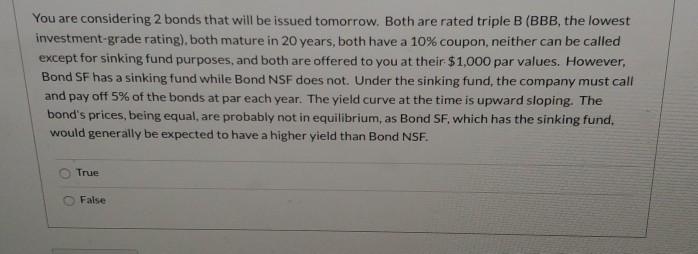

You are considering 2 bonds that will be issued tomorrow. Both are rated triple B (BBB, the lowest investment-grade rating), both mature in 20 years, both have a 10% coupon, neither can be called except for sinking fund purposes, and both are offered to you at their $1,000 par values. However, Bond SF has a sinking fund while Bond NSF does not. Under the sinking fund, the company must call and pay off 5% of the bonds at par each year. The yield curve at the time is upward sloping. The bond's prices, being equal, are probably not in equilibrium, as Bond SF, which has the sinking fund, would generally be expected to have a higher yield than Bond NSF. True False

Step by Step Solution

There are 3 Steps involved in it

The image presents a statement about two bonds that are being considered for investment Both bonds are rated triple B mature in 20 years and offer a 1... View full answer

Get step-by-step solutions from verified subject matter experts