Question: You are considering 2 models for a manufacturing plant over a very long period of time, for a discount rate of 10% compounded annually. Model

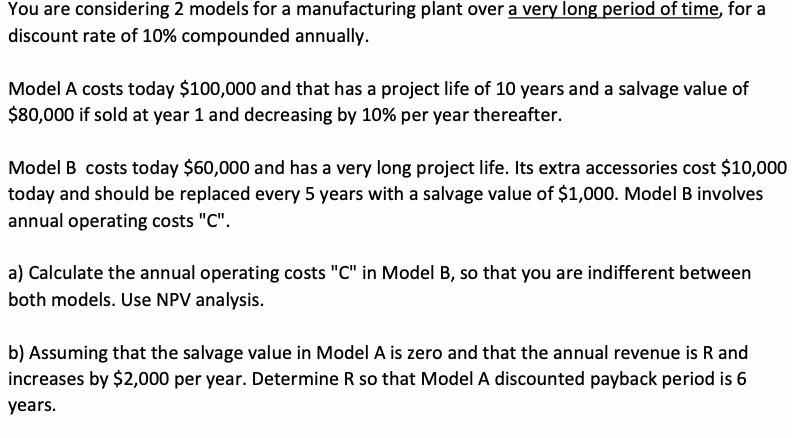

You are considering 2 models for a manufacturing plant over a very long period of time, for a discount rate of 10% compounded annually. Model A costs today $100,000 and that has a project life of 10 years and a salvage value of $80,000 if sold at year 1 and decreasing by 10% per year thereafter. Model B costs today $60,000 and has a very long project life. Its extra accessories cost $10,000 today and should be replaced every 5 years with a salvage value of $1,000. Model B involves annual operating costs "C". a) Calculate the annual operating costs "C" in Model B, so that you are indifferent between both models. Use NPV analysis. b) Assuming that the salvage value in Model A is zero and that the annual revenue is R and increases by $2,000 per year. Determine R so that Model A discounted payback period is 6 years. You are considering 2 models for a manufacturing plant over a very long period of time, for a discount rate of 10% compounded annually. Model A costs today $100,000 and that has a project life of 10 years and a salvage value of $80,000 if sold at year 1 and decreasing by 10% per year thereafter. Model B costs today $60,000 and has a very long project life. Its extra accessories cost $10,000 today and should be replaced every 5 years with a salvage value of $1,000. Model B involves annual operating costs "C". a) Calculate the annual operating costs "C" in Model B, so that you are indifferent between both models. Use NPV analysis. b) Assuming that the salvage value in Model A is zero and that the annual revenue is R and increases by $2,000 per year. Determine R so that Model A discounted payback period is 6 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts