Question: You are considering 2 mutually exclusive projects, both of which are renewable. Project A: an investment of $400 that will increase annual operating revenue by

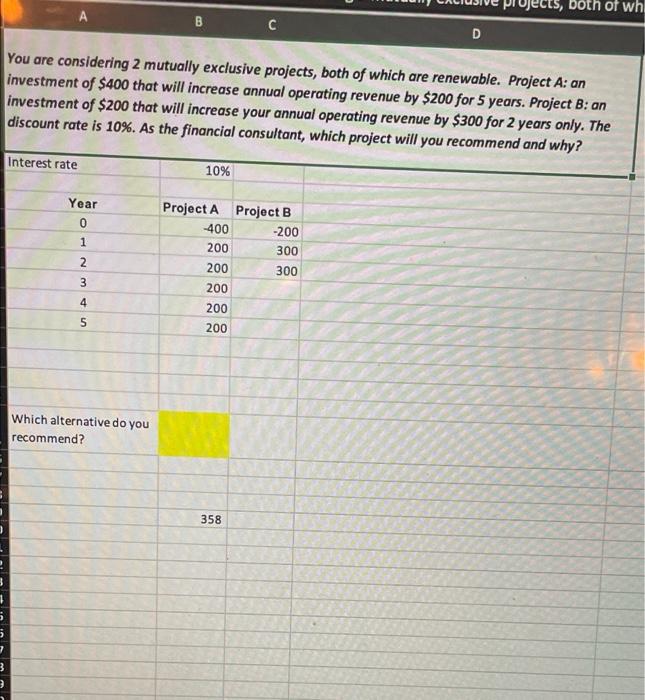

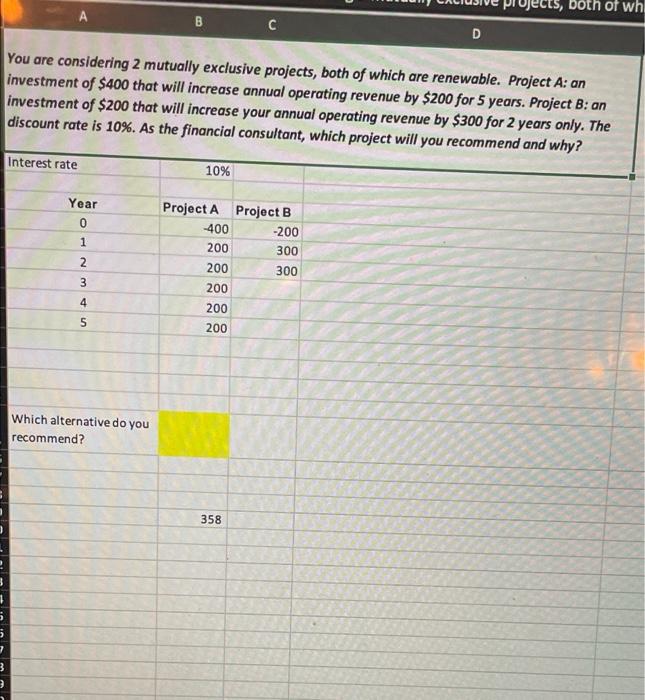

You are considering 2 mutually exclusive projects, both of which are renewable. Project A: an investment of $400 that will increase annual operating revenue by $200 for 5 years. Project B: an investment of $200 that will increase your annual operating revenue by $300 for 2 years only. The discount rate is 10%. As the financial consultant, which project will you recommend and why?

please show work using excel, please show the steps taken to solve problem please in excel!!!

CIS, both of wh A B D You are considering 2 mutually exclusive projects, both of which are renewable. Project A: an investment of $400 that will increase annual operating revenue by $200 for 5 years. Project B: on investment of $200 that will increase your annual operating revenue by $300 for 2 years only. The discount rate is 10%. As the financial consultant, which project will you recommend and why? Interest rate 10% Year 0 1 2 Project A Project B -400 -200 200 300 200 300 200 200 200 3 4 5 Which alternative do you recommend? 358 7 3 3

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock