Question: You are considering a new project that requires an initial investment of $500. After year 3, cash flows will grow at a rate of 3%

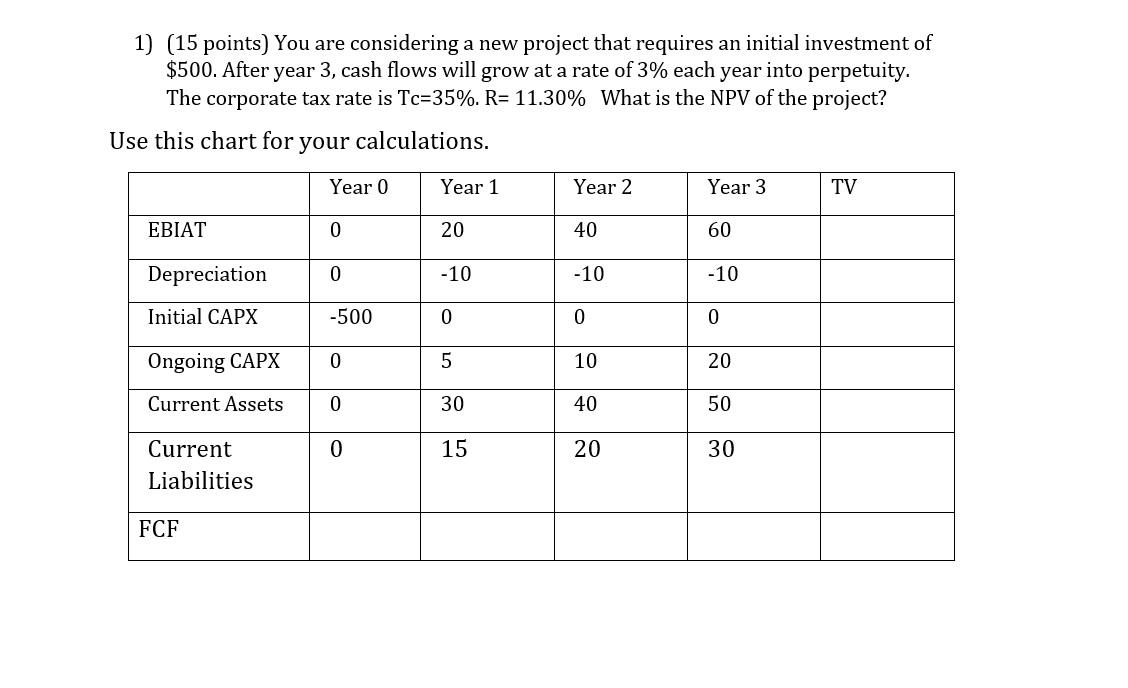

You are considering a new project that requires an initial investment of $500. After year 3, cash flows will grow at a rate of 3% each year into perpetuity. The corporate tax rate is Tc=35%. R= 11.30% What is the NPV of the project?

Use this chart for your calculations.

|

| Year 0 | Year 1 | Year 2 | Year 3 | TV |

| EBIAT | 0 | 20 | 40 | 60 |

|

| Depreciation | 0 | 10 | 10 | 10 |

|

| Initial CAPX | 500 | 0 | 0 | 0 |

|

| Ongoing CAPX | 0 | 5 | 10 | 20 |

|

| Current Assets | 0 | 30 | 40 | 50 |

|

| Current Liabilities | 0 | 15 | 20 | 30 |

|

| FCF |

|

|

|

|

|

1) (15 points) You are considering a new project that requires an initial investment of $500. After year 3 , cash flows will grow at a rate of 3% each year into perpetuity. The corporate tax rate is Tc=35%.R=11.30% What is the NPV of the project? Use this chart for your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts