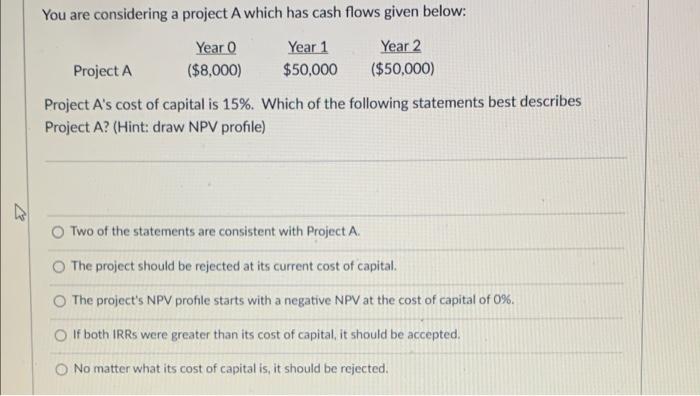

Question: You are considering a project A which has cash flows given below: Year 0 Year 1 Year 2 Project A ($8,000) $50,000 ($50,000) Project A's

You are considering a project A which has cash flows given below: Year 0 Year 1 Year 2 Project A ($8,000) $50,000 ($50,000) Project A's cost of capital is 15%. Which of the following statements best describes Project A? (Hint: draw NPV profile) . Two of the statements are consistent with Project A. The project should be rejected at its current cost of capital The project's NPV profile starts with a negative NPV at the cost of capital of 0%. If both IRRs were greater than its cost of capital, it should be accepted. No matter what its cost of capital is, it should be rejected

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock