Question: You are considering a project that will require an initial outlay of $54,200. This project has an expected lifeof 5 years and will generate free

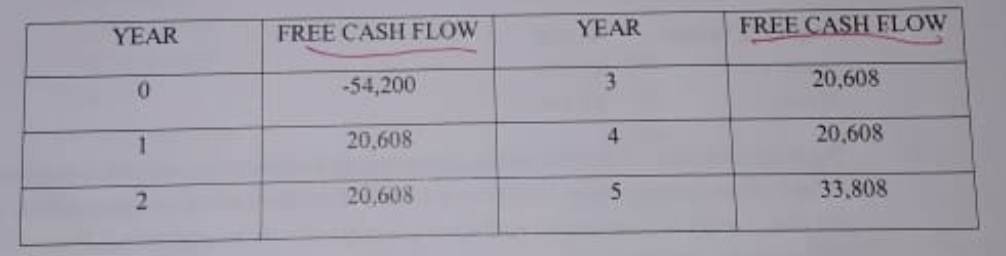

You are considering a project that will require an initial outlay of $54,200. This project has an expected lifeof 5 years and will generate free cash flows to the company as a whole of $20,608 at the end of each year over its 5-year life. In addition to the $20,608 cash flow from operations at the end of the fifth and final year, there will be an additional free cash inflow of $13,200 at the end of the fifth year associated with the salvage value of the machine, making the cash flow in year 5 equal to $33,808. Thus, the free cash flows associated with this project look like this:  REQUIRED: 1) Given a required rate of return of 15 percent, calculate the Net Present Value 2)Should this project be accepted? Justify.

REQUIRED: 1) Given a required rate of return of 15 percent, calculate the Net Present Value 2)Should this project be accepted? Justify.

YEAR FREE CASH FLOW YEAR FREE CASH FLOW -54,200 20,608 20,608 20,608 20,608 33.808

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts