Question: You are considering adding a small-cap value fund (SV) to your portfolio, which currently consists only of a mutual fund that tracks the S&P500. You

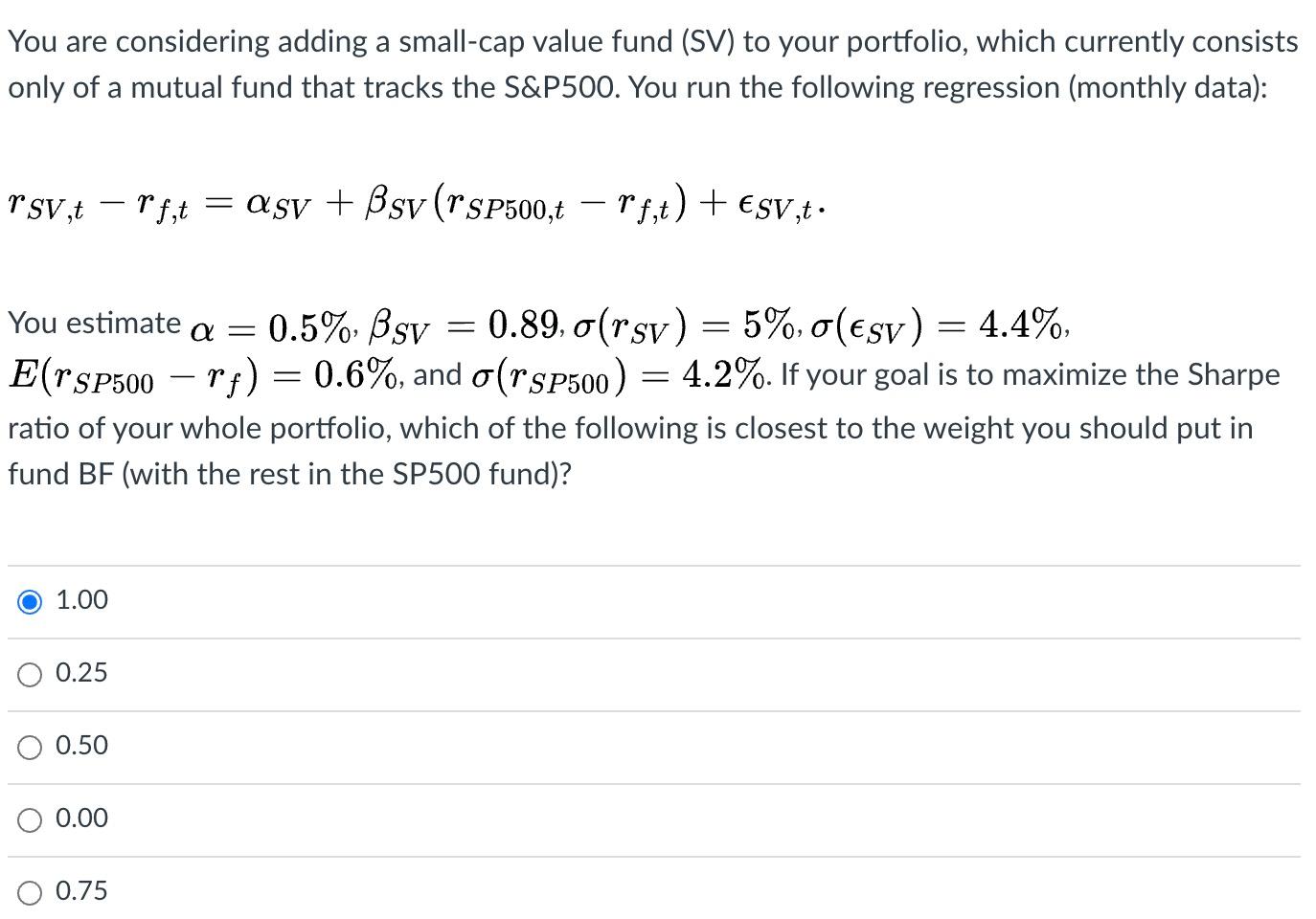

You are considering adding a small-cap value fund (SV) to your portfolio, which currently consists only of a mutual fund that tracks the S&P500. You run the following regression (monthly data): TSV,t - rf,t = asv + Bsv (TSP500,t rf,t) + 5V,t. You estimate a = 0.5%;Bsy = 0.89, 0(rsv) = 5%, 0(esv) = 4.4%, E(TSP500 1f) = 0.6%, and o(r SP500) = 4.2%. If your goal is to maximize the Sharpe ratio of your whole portfolio, which of the following is closest to the weight you should put in fund BF (with the rest in the SP500 fund)? 1.00 0.25 0.50 0.00 O 0.75 You are considering adding a small-cap value fund (SV) to your portfolio, which currently consists only of a mutual fund that tracks the S&P500. You run the following regression (monthly data): TSV,t - rf,t = asv + Bsv (TSP500,t rf,t) + 5V,t. You estimate a = 0.5%;Bsy = 0.89, 0(rsv) = 5%, 0(esv) = 4.4%, E(TSP500 1f) = 0.6%, and o(r SP500) = 4.2%. If your goal is to maximize the Sharpe ratio of your whole portfolio, which of the following is closest to the weight you should put in fund BF (with the rest in the SP500 fund)? 1.00 0.25 0.50 0.00 O 0.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts