Question: You are considering an ATM bear put spread on a stock trading at $142.14 per share. Using the following information, what is the spreads return

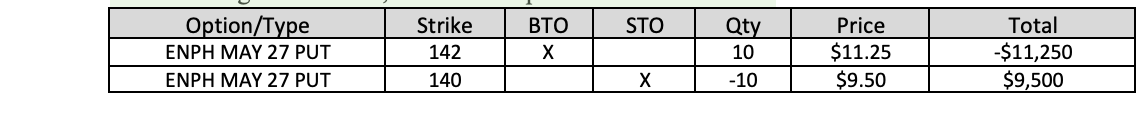

You are considering an ATM bear put spread on a stock trading at $142.14 per share. Using the following information, what is the spreads return on risk?

STO Option/Type ENPH MAY 27 PUT ENPH MAY 27 PUT Strike 142 140 BTO Qty 10 -10 Price $11.25 $9.50 Total -$11,250 $9,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts