Question: You are considering constructing a new plant in a remote wilderness area to process the ore from a planned mining operation. You anticipate that the

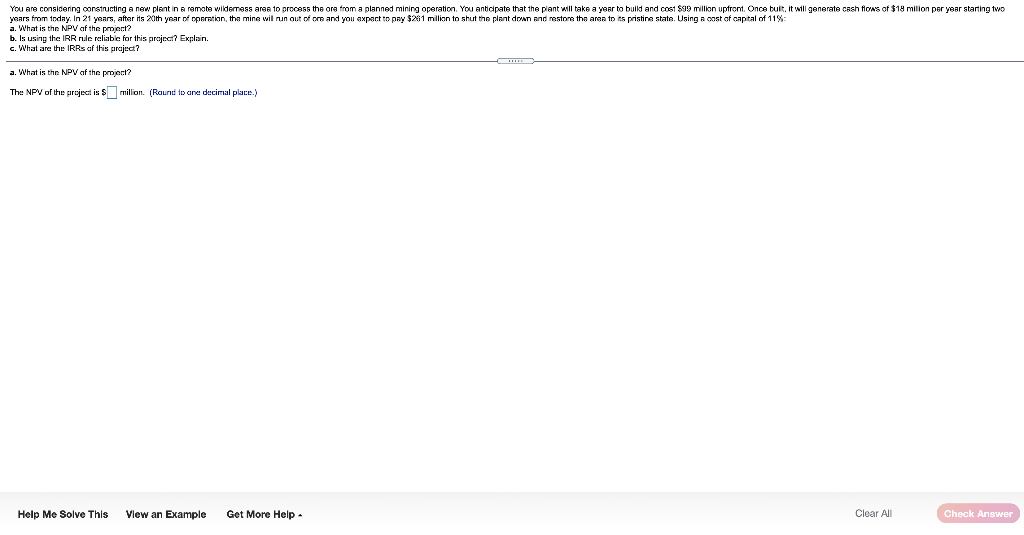

You are considering constructing a new plant in a remote wilderness area to process the ore from a planned mining operation. You anticipate that the plant will take a year to build and cost $99 million upfront. Once buit, it will generate cash flors of $18 milion per year starting two years from today. In 21 years, after its 20th year of operation, the mine will run out of one and you expect to pay $2 1 million to shut the plant down and restore the area to its pristine state. Using a cost of capital of 11% a. What is the NPV of the project b. ls using the IRR rule reliable for this projec? Explain. c. What are the IRRs of this project? a. What is the NPV of the project? The NPV of the project is $ million (Round to and decimal place.) Help Me Solve This View an Example Get More Help Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts