Question: You are considering either leasing or purchasing a car. You notice an ad that says you can lease the car you want for $286.00 per

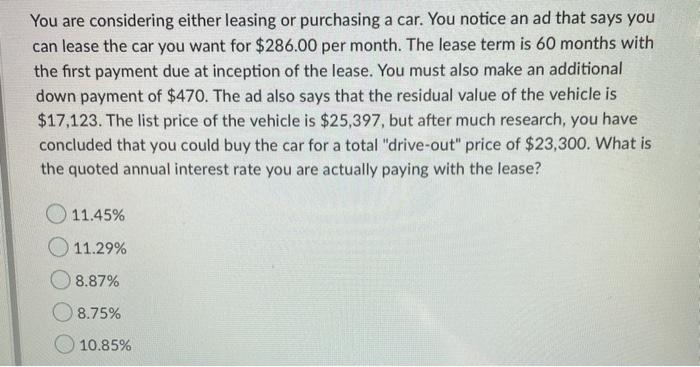

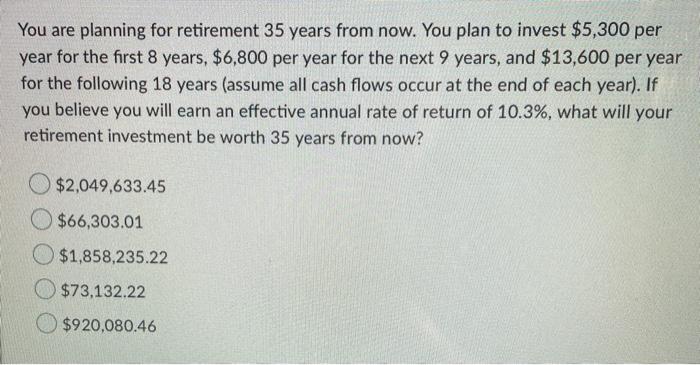

You are considering either leasing or purchasing a car. You notice an ad that says you can lease the car you want for $286.00 per month. The lease term is 60 months with the first payment due at inception of the lease. You must also make an additional down payment of $470. The ad also says that the residual value of the vehicle is $17,123. The list price of the vehicle is $25,397, but after much research, you have concluded that you could buy the car for a total drive-out" price of $23,300. What is the quoted annual interest rate you are actually paying with the lease? 11.45% 11.29% 8.87% 8.75% 10.85% You are planning for retirement 35 years from now. You plan to invest $5,300 per year for the first 8 years, $6,800 per year for the next 9 years, and $13,600 per year for the following 18 years (assume all cash flows occur at the end of each year). If you believe you will earn an effective annual rate of return of 10.3%, what will your retirement investment be worth 35 years from now? $2,049,633.45 $66,303.01 $1,858,235.22 $73,132.22 $920,080.46

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts