Question: You are considering investing in a project that will require an initial capital outlay of $20000 and generate annual cash flows of $3115 for 10

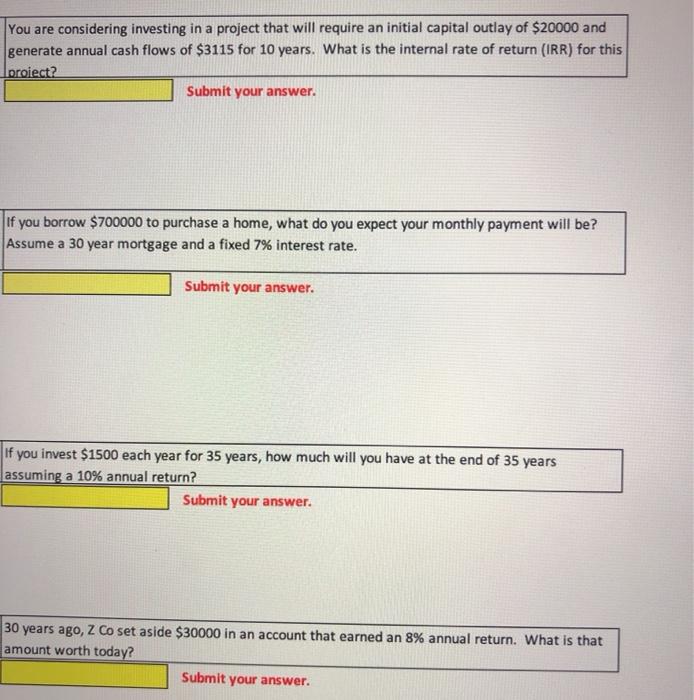

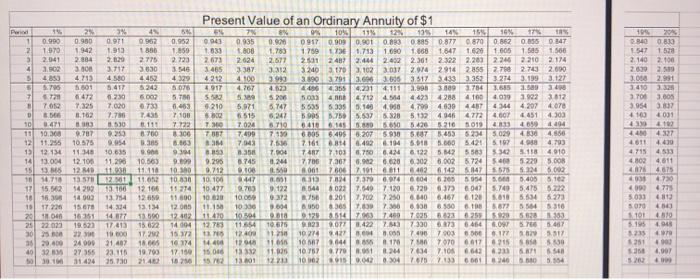

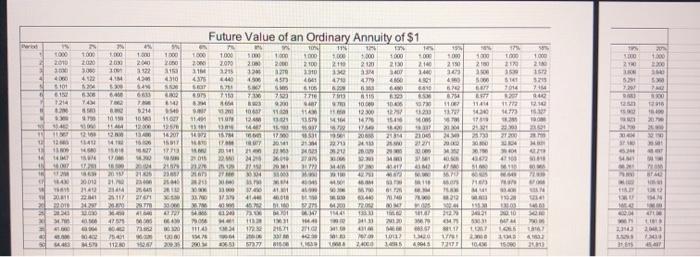

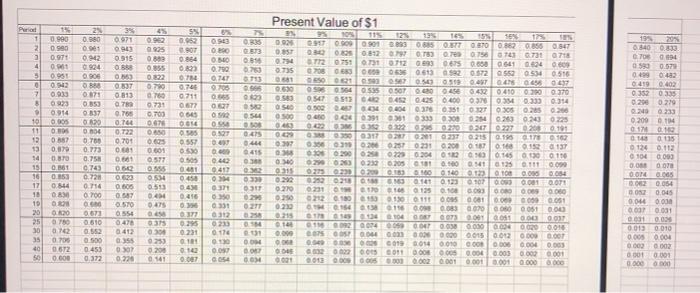

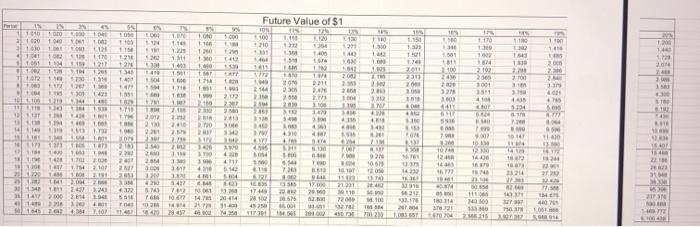

You are considering investing in a project that will require an initial capital outlay of $20000 and generate annual cash flows of $3115 for 10 years. What is the internal rate of return (IRR) for this lproiect Submit your answer. If you borrow $700000 to purchase a home, what do you expect your monthly payment will be? Assume a 30 year mortgage and a fixed 7% interest rate. Submit your answer. If you invest $1500 each year for 35 years, how much will you have at the end of 35 years assuming a 10% annual return? Submit your answer. 30 years ago, Z Co set aside $30000 in an account that earned an 8% annual return. What is that amount worth today? Submit your answer. Present Value of an Ordinary Annuity of $1 WC 0043 25 0.900 1942 2.884 30 4713 5501 6472 7325 11.162 83 0787 10.575 11 340 12.100 124 4 0962 1850 2775 3830 4452 5.242 6007 0.730 0.971 1.913 2.6.20 3.717 4580 5.417 1.250 7.000 7.7 3.530 90 9054 10.635 11.200 11.03 Pried 0.990 2 1.570 3 4 3.50 5 4853 5 S75 7 6720 7.012 3.56 10 1.471 1150.300 12.11.2016 13 12:14 14 13.004 15 13.865 101 141 125.962 18 15.30 19 17:22 2010 2522023 30 36 40 SN 0.952 1.550 2.723 3.546 4329 5076 5. 03 7100 72122 8.300 8.663 9304 2673 3.465 4212 4917 5.1 5210 COC POP 0.02 1.783 2.677 3.312 3990 23 5200 5.147 6.347 110 7.99 7.56 7.804 3.244 159 111 700 3.305 8.900 10.563 0.935 1.800 2624 3.387 4100 4767 5.3 5.971 6515 70M 7.499 7.43 350 3.745 D400 97447 2.763 10.06 10 10 10 11654 1240 12948 13 32 10% 12 14 0917 0.90 0.901 0.893 0.885 0.8770870 0.862 0.25 0347 1759 173 1.713 1.690 1 11865 1647 1624 1.605 155 1.566 2501 24B72.444 2.400 2.361 2.22 2.200 2240 2210 2174 3.240 370 3102 303 2914 2914 2855 2.70 2743 2.690 37890 371 3.63.636 3517 34433 3352 3274 3.199 3.127 4686 4355 4,201 151 3.889 1754 1.00 31 5003 4 4712 4.614 443 4288 4100 4,099 3.922 3812 5535 5335 5.100 4 MB 4.790 4.630 4457 4344 4.207 407 5.995 8.750 5.597 5.30 5132 4946 4772 4.607 6.416 6.165.00 56 5220 5.210 5019 4333 4099 6 005 6,4956207 5938 5.687 5.453 5234 4336 4.586 7161 814.492 58 5.000 5.42 512 498 4.793 747 7103710 8.414 8.122 5.1428583 530 5.11 4.910 7706 7.3678.982 6.620 8302 0.002 6.724 5. 5.229 5.000 8001 780614101 6811 402 6.14 5147 5.575 5.324 6.00 113 77.3 0.014 604 6205 5954 5. 5.400 5102 6,0237.649 7 120 6.720 6373 5.74 5.475 5772 25 6.2017.702 7.250 0840 6.467 6.120 010 5.534 6273 8350 8.365 7.8.970 6.30 8550 8. 5377 5564 5310 9713 7.400 7,0958823 6255 5820 582 1383 9123 8.773.422 7.543 7.330 63 6464 w 5.7 10274 3.427 3.000 7400 7003 60177 30 31 10 567 064468170 750 7070 601716915 Sasa 5.630 10.757 770.051 244 7034 7.10 43 633 5. SEN 10 120100120304 76157133 0020 50 5.554 105 2040 0.940 0.830 1547 1578 2.140 2.100 2.6.30 2.59 3.000 2.991 3.490 3.TO 3.805 3.954 4100 4031 410 4102 4.4 4327 4611 4.490 4533 4802 4,811 47 4.875 47 4999 4775 5033 481 5.00 4 101 4570 O 01 ROL 1357 CO TO 7 BBT 8314 833 9.295 9.212 10.100 10.477 108 11.15 12470 12.73 11 14.40 15.06 12 540 14200 14992 1567 1651 19.623 22 24004 27 355 11.494 9122 372 9.604 13100 13 754 14 34 14677 17.613 18.000 21.402 23.115 35.750 11.02 12164 1264 13 14 11.500 15.622 17.29 18.00 1973 21.40 15214 11 800 120 12402 14104 15 m2 16 174 17150 5.667 10.615 12 3116 11 25 000 WCE 5235 251 250 522 4000 4.907 9 OL 000 LE 10 2031 RE 100 200 300 Future Value of an Ordinary Annuity of $1 10 119 EN 1200 1000 10 1200 100 2000 2110 21 2160 3310 164 84 45 67 70 con 771 7 ZOO 3153 30 1000 2150 300 1300 2.30 WEE 1000 21 167 579 744 LE ME . 4 WS ST RE EVE 66 S L2 7 0714 NL 7214 RA 11414 NA 117 20 20 100 5.114 10 W 116 12 1674 10 1141 11 NE NS 116 LES 20 2014 ME EUR 11 13 20 M 212 LEN 21 2011 21 H ON US IM GE 4 X SON NE ANN 2013 WS M 1417 MU 40 M 16 MI MP SIE MO LOK 2014 1 WE MU TI BE IT M OM M TI w 414 26 1 ME 2011 CER 14 TR W COM M 10 1 M 41 44 2 32 EM 10 U 4 w w O S. 16 M G 14 216 WID ME ABS 2011 WY RE 1 15 MON 2003 NIE 02 Pero 1 NZ VE 0.580 960 O93 20 08 SCRO 33 3 4 0.990 0.90 0.971 0901 0.951 0.943 0971 0943 0315 0.88 0.42 0924 5 0.052 1.907 0.864 0.23 074 0.746 0.711 50 25 0.800 0.855 0.222 0.70 310 5 3066 0.790 0.14 PESO 20 10 007 7 8 COD 6 Q 0.627 O2 09 DIST 0.544 0923 0.914 0305 0.05 0657 0.00 0.87 NO 0:45 0337 090 04 0.760 0.773 0.75 0743 0.72 0.14 0807 0.813 70 0.76 O. 0.722 0.700 0.681 D. 0.50 0623 60 0687 0570 0.554 0.476 0.731 0.700 0.67 0.40 Q. 01801 0577 D555 0.534 06 0.614 o. 0.557 0530 505 Present Value of $1 NO 115 12 165 SER 925 901 03 065 0.0208560547 0.857 0.62 79 0752 0.75643 731 0718 0.794 31 112 30675085061 64 0 0.735 2006 0536 0613 553 02516 681 SO DE 509 104N 0437 50507 ASE 04 0410 0300 370 0.583 95470513 6.400 0.370 934 0.330 os 0 0.404 310 0.550 0305 0.265 0200 500 40 3911 333 03080264 0260 024 2025 2026 227 200.101 DEN 350 3170201237 0.215 0173762 35639 02310200 187 0.100.152137 200229 0204 052 0.145 000 100 0340 2003 181 000 0.541 125 1110.000 0911 150 140 100 0.00 0.00 0292 0.141 0.123107 OO 000071 0.270 30 0.00 0.00 0212 0.180 1101110095 0001 0000000051 154 155 GON 003 0.00 0215 17 000 0.01000 000000000000000001 675 000 000 000 00150012 0.000000 . 040 019 018 0010 000 000 0.004 0.003 02215011004 005 0.0040003 2001 0021 2013000005 0.000 0.00 0.00 0.00 0.00 0.000 BIO 15 10 11 12 13 14 15 10 17 18 19 20 25 30 35 40 50 CO 195 20% 0 840 706 094 OS 049 0:42 0410 0.402 0.350 03 0.200 0219 20 0233 0200 14 174 1 0115 0124 0.112 01040093 0.000 00 DON 0005 B002 0.054 0.045 0.000.000 OP 0.031 B009 0.0130010 0.000000 0.002 0.002 0.001 0.001 0.000000 PO SO 0412 04 053 034 0.83 24 0.456 30 311 020 0900 TO 0350 0.475 20 0312 LITO VE are 0700 0.672 0.000 01510 552 2.500 0453 0.372 0.30 0253 0200 0.141 11 0170 130 0.03 00:54 0.00 0307 0.220 CO HDD M V SH 100 20 VI 100 3.600 Future Value of $1 ON 100 11 210 27 308 100 10 1.000 100 1 1 1.00 1100 120 10 1.151 133 1100 110 10 12 +30 1. 114 1.22 1. 1 1. 1,200 140 YM TOS! 210 2 11 19 w RE 2000 10 TOP DE 100 14 2.100 23 110 42 2001 AFT NA 10 24 11 230 1. TA 1 90 11 2211 24 3. 20 21 2 WE 4.7 T OP 20 23 2016 270 23 WEE WP + 111 LTH LO 14 100 3210 300 4411 45 2003 410 cor 10 NE ME WE RE 1.44 4 21 2 2010 RE 20 21 2 . 41 5916 NE 2.TO 1 14 PE MET PON UN WE 10 2 11 TA 7, 1 2020 14 3.197 28 254 PU 42 10 124 . 14 40 4 11 CS 22 161 4 TER 361 BE ON 105 1101 TA 1 HOT 18 12 17 18 10 CHE US THE GLEDE 14 1942 24 C WE 1961 2000 4.13 65 29 4 76 1062 16 174 28 43 17 01" 14.444 20 56 1911 7200 111 101 180114 CER 213 WEB 20 2014 BAOB 400 LO GO 2 133.00 26 46704 ELE 1816

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts