Question: You are considering purchasing a $1,000 face value A rated bond with 9.75 years to maturity and a coupon rate of 8.650% with semiannual payments.

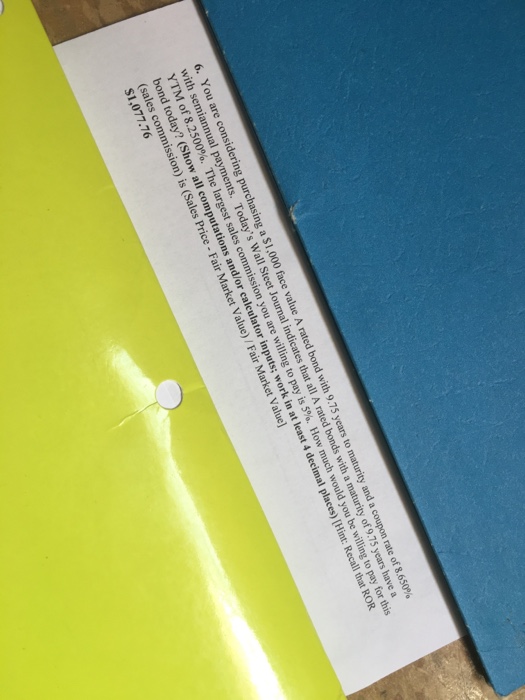

You are considering purchasing a $1,000 face value A rated bond with 9.75 years to maturity and a coupon rate of 8.650% with semiannual payments. Today's Wall Steet Journal indicates that all A rated bonds with a maturity of 9.75 years have a YTM of 8.2500%. The largest sales commission you are willing to pay is 5%. How much would you be willing to pay for this bond today? (Show all computations and/or calculator inputs; work in at least 4 decimal places) $1,077.76

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts