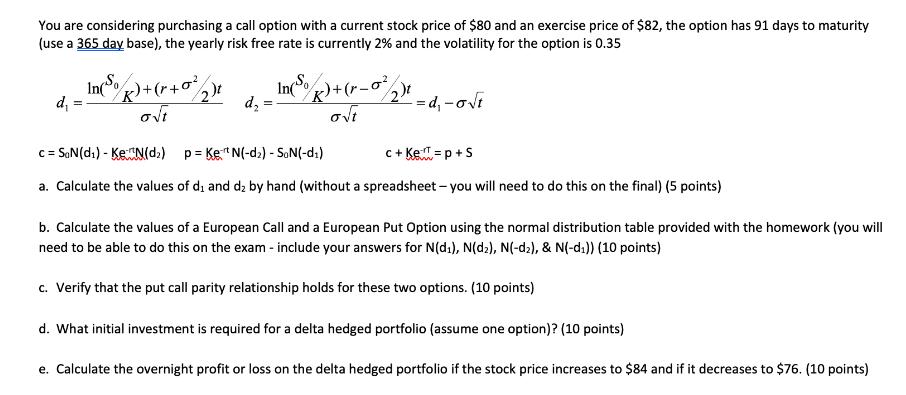

Question: You are considering purchasing a call option with a current stock price of $80 and an exercise price of $82, the option has 91

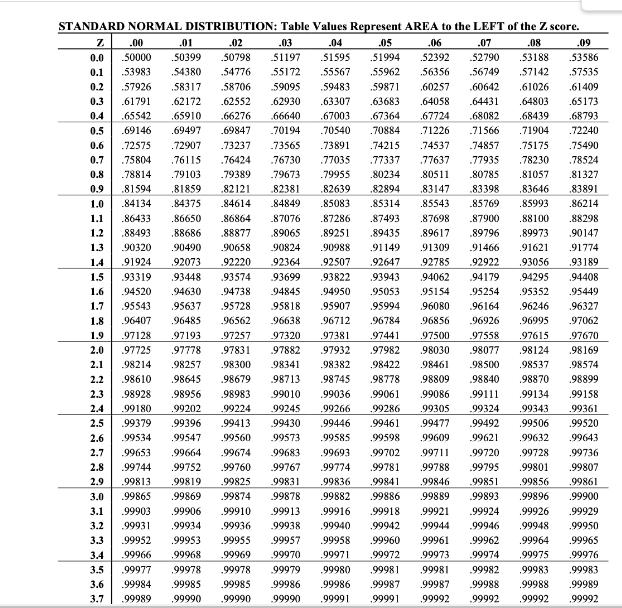

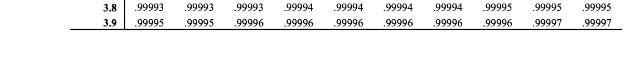

You are considering purchasing a call option with a current stock price of $80 and an exercise price of $82, the option has 91 days to maturity (use a 365 day base), the yearly risk free rate is currently 2% and the volatility for the option is 0.35 d = = In(SR) + (r + 2) t ot d= In(S k) + (r = 0 /2 out =d-ot c = SaN(d) - Ke N(d) p = KeN(-d) - SoN(-d) a. Calculate the values of d and d by hand (without a spreadsheet-you will need to do this on the final) (5 points) c+ Ke=p+S b. Calculate the values of a European Call and a European Put Option using the normal distribution table provided with the homework (you will need to be able to do this on the exam - include your answers for N(d), N(dz), N(-d), & N(-d)) (10 points) c. Verify that the put call parity relationship holds for these two options. (10 points) d. What initial investment is required for a delta hedged portfolio (assume one option)? (10 points) e. Calculate the overnight profit or loss on the delta hedged portfolio if the stock price increases to $84 and if it decreases to $76. (10 points) STANDARD NORMAL DISTRIBUTION: Table Values Represent AREA to the LEFT of the Z score. Z .00 .01 .02 .04 .05 .06 .07 .08 0.0 .50000 .50399 51595 .51994 52392 52790 53188 .50798 54776 0.1 53983 .54380 .55567 .55962 .56356 .56749 .57142 0.2 .57926 .58317 .58706 59095 .59483 59871 .60257 60642 .61026 0.3 .61791 .62172 .62552 .62930 .63307 .64058 .64431 .64803 .67724 .68082 .68439 0.4 .65542 .65910 0.5 .69146 .69497 .69847 -70194 .71226 .71566 .71904 74857 0.6 .72575 .72907 .73237 -73565 .74537 .75175 .77935 .78230 .77337 77637 .80234 .80511 .80785 .81057 .83147 .85543 .85769 .83398 .83646 .85993 .88100 .87493 .87698 .87900 .89617 .89796 .89973 .89435 91149 1.3 90320 .90988 91309 91466 .91621 1.4 92507 .92647 92785 .92922 93056 94062 94179 94295 1.5 .63683 .66276 .66640 .67003 .67364 .70540 .70884 .73891 74215 0.7 .75804 .76115 76424 .76730 .77035 0.8 78814 .79103 .79389 .79673 .79955 0.9 .81594 .81859 82121 82381 .82639 .82894 1.0 .84134 .84375 .84614 84849 .85083 .85314 1.1 .86433 .86650 .86864 -87076 .87286 1.2 .88493 .88686 .88877 .89065 .89251 90490 90658 90824 91924 92073 .92220 92364 93319 93448 .93574 93699 .93822 .93943 94520 .94630 94738 94845 94950 .95053 .95154 95254 1.7 95543 .95637 .95728 95818 .95907 .95994 .96080 .96164 1.8 96407 .96485 .96562 96638 96712 .96784 .96856 .96926 1.9 .97128 .97193 .97257 97320 97381 .97441 97500 97558 2.0 .97725 .97778 .97831 97882 97932 97982 .98030 .98077 2.1 .98214 .98257 98300 98341 98382 .98422 98461 .98500 .98537 2.2 .98610 .98645 .98679 98713 .98745 .98778 .98809 .98840 .98870 2.3 .98928 98956 98983 99010 .99036 .99061 .99086 .99111 .99134 2.4 .99180 .99202 .99224 99245 .99266 .99286 .99305 99324 2.5 .99379 .99396 .99413 99430 99446 .99461 99477 2.6 .99534 .99547 .99560 9957 .99585 .99598 .99609 99621 2.7 .99653 99664 .99674 99683 .99711 .99720 2.8 .99744 .99752 .99760 99767 99788 1.6 .95352 .96246 .96995 .97615 .97670 .98124 .98169 98574 98899 .99158 .99343 .99361 99492 .99506 .99520 99632 99643 .99693 .99702 .99728 .99736 .99774 .99781 99795 99801 .99807 99831 99836 .99841 99846 99851 99856 .99861 99878 99882 .99889 99893 .99896 99900 .99921 99924 99926 .99929 .99948 .99950 2.9 .99813 .99819 .99825 3.0 .99865 .99869 99874 99886 3.1 99903 .99906 .99910 99913 99916 99918 3.2 .99931 .99934 .99936 99938 .99940 99942 99944 99946 3.3 99952 99953 .99955 .99957 .99958 .99960 99961 3.4 .99966 99968 .99969 99970 99971 99972 3.5 99977 99978 .99978 99979 99980 99981 99981 .99982 3.6 .99984 .99985 99985 99986 .99986 99987 99987 99988 3.7 .99989 99990 .99990 99990 .99991 .99991 .99962 .99964 .99965 .99973 99974 .99975 .99976 99983 .99983 .99988 .99989 .99992 99992 99992 .99992 .03 51197 55172 .09 53586 .57535 .61409 .65173 .68793 .72240 .75490 .78524 81327 .83891 .86214 .88298 .90147 91774 .93189 94408 .95449 96327 97062 3.8 .99993 3.9 .99995 .99993 .99993 99994 .99994 .99996 99996 99996 99995 .99994 99994 .99996 .99996 99995 .99995 99996 .99995 99997 .99997

Step by Step Solution

3.35 Rating (139 Votes )

There are 3 Steps involved in it

ANSWER To calculate the values of d and d we can use the following formulas d lnSK r 2 t t d d t Given the following parameters Current stock price S 80 Exercise price K 82 Riskfree rate r 2 002 Volat... View full answer

Get step-by-step solutions from verified subject matter experts