Question: You are considering purchasing a five-year A-rated Corporate Bond with a coupon of 2.5% paid annually, face value of $1,000. You observe that the market

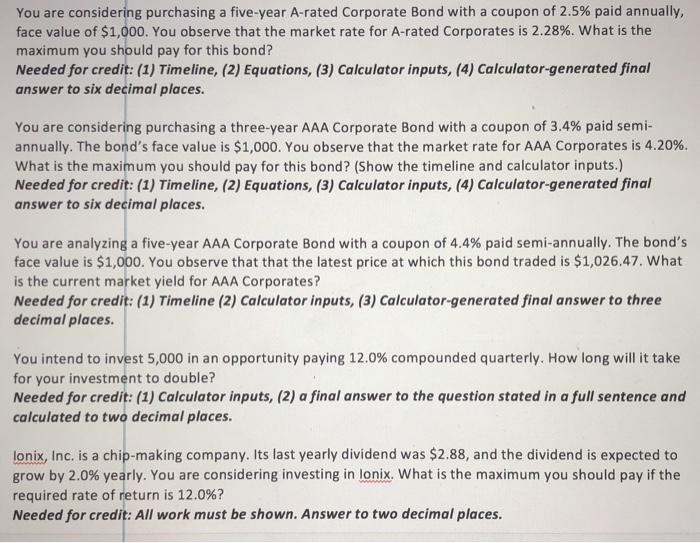

You are considering purchasing a five-year A-rated Corporate Bond with a coupon of 2.5% paid annually, face value of $1,000. You observe that the market rate for A-rated Corporates is 2.28%. What is the maximum you should pay for this bond? Needed for credit: (1) Timeline, (2) Equations, (3) Calculator inputs, (4) Calculator-generated final answer to six decimal places. You are considering purchasing a three-year AAA Corporate Bond with a coupon of 3.4% paid semi- annually. The bond's face value is $1,000. You observe that the market rate for AAA Corporates is 4.20%. What is the maximum you should pay for this bond? (Show the timeline and calculator inputs.) Needed for credit: (1) Timeline, (2) Equations, (3) Calculator inputs, (4) Calculator-generated final answer to six decimal places. You are analyzing a five-year AAA Corporate Bond with a coupon of 4.4% paid semi-annually. The bond's face value is $1,000. You observe that that the latest price at which this bond traded is $1,026.47. What is the current market yield for AAA Corporates? Needed for credit: (1) Timeline (2) Calculator inputs, (3) Calculator-generated final answer to three decimal places. You intend to invest 5,000 in an opportunity paying 12.0% compounded quarterly. How long will it take for your investment to double? Needed for credit: (1) Calculator inputs, (2) a final answer to the question stated in a full sentence and calculated to two decimal places. lonix, Inc. is a chip-making company. Its last yearly dividend was $2.88, and the dividend is expected to grow by 2.0% yearly. You are considering investing in lonix. What is the maximum you should pay if the required rate of return is 12.0%? Needed for credit: All work must be shown. Answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts