Question: You are considering purchasing a machine (use your imagination) that will initially cost $205,000.00. The machine is expected to last 7 years, and you project

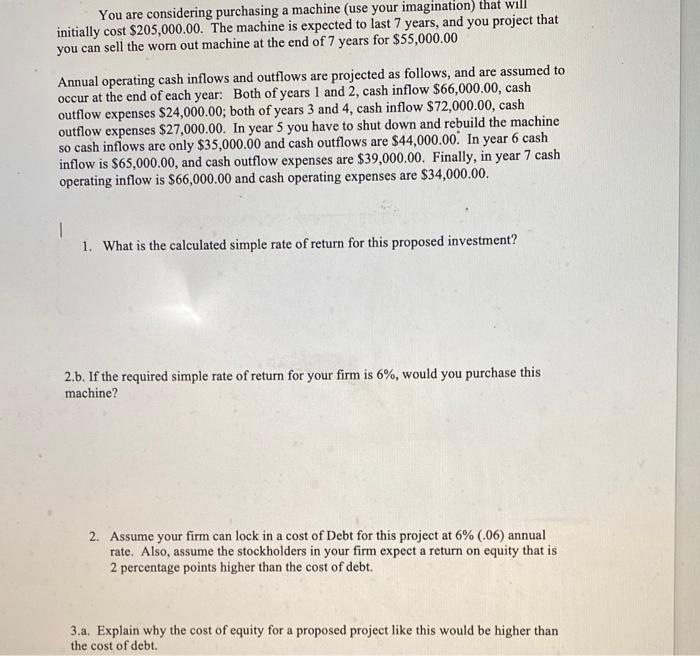

You are considering purchasing a machine (use your imagination) that will initially cost $205,000.00. The machine is expected to last 7 years, and you project that you can sell the worn out machine at the end of 7 years for $55,000.00 Annual operating cash inflows and outflows are projected as follows, and are assumed to occur at the end of each year: Both of years 1 and 2, cash inflow $66,000.00, cash outflow expenses $24,000.00; both of years 3 and 4, cash inflow $72,000.00, cash outflow expenses $27,000.00. In year 5 you have to shut down and rebuild the machine so cash inflows are only $35,000.00 and cash outflows are $44,000.00. In year 6 cash inflow is $65,000.00, and cash outflow expenses are $39,000.00. Finally, in year 7 cash operating inflow is $66,000.00 and cash operating expenses are $34,000.00. 1 1. What is the calculated simple rate of return for this proposed investment? 2.b. If the required simple rate of return for your firm is 6%, would you purchase this machine? 2. Assume your firm can lock in a cost of Debt for this project at 6% (.06) annual rate. Also, assume the stockholders in your firm expect a return on equity that is 2 percentage points higher than the cost of debt. 3.a. Explain why the cost of equity for a proposed project like this would be higher than the cost of debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts