Question: You are considering purchasing a new injection molding machine. This machine will have an estimated service life of 11 years with a negligible after-tax salvage

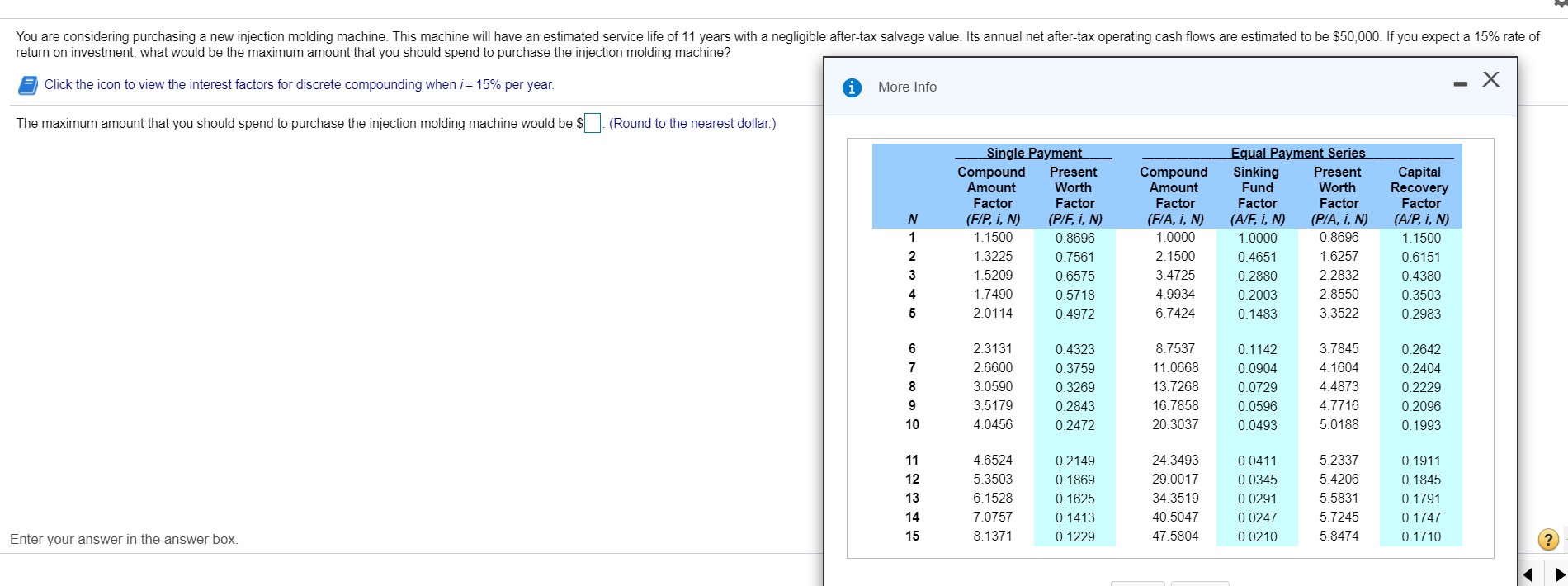

You are considering purchasing a new injection molding machine. This machine will have an estimated service life of 11 years with a negligible after-tax salvage value. Its annual net after-tax operating cash flows are estimated to be $50,000. If you expect a 15% rate of return on investment, what would be the maximum amount that you should spend to purchase the injection molding machine? Click the icon to view the interest factors for discrete compounding when i = 15% per year. More Info x The maximum amount that you should spend to purchase the injection molding machine would be $. (Round to the nearest dollar.) N 1 2 3 4 Single Payment Compound Present Amount Worth Factor Factor (F/P, i, N) (P/F, I, N) 1.1500 0.8696 1.3225 0.7561 1.5209 0.6575 1.7490 0.5718 2.0114 0.4972 Compound Amount Factor (F/A, I, N) 1.0000 2.1500 3.4725 4.9934 6.7424 Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, I, N) (P/A, i, N) 1.0000 0.8696 0.4651 1.6257 0.2880 2.2832 0.2003 2.8550 0.1483 3.3522 Capital Recovery Factor (A/P, i, N) 1.1500 0.6151 0.4380 0.3503 0.2983 5 6 7 8 9 10 2.3131 2.6600 3.0590 3.5179 4.0456 0.4323 0.3759 0.3269 0.2843 0.2472 8.7537 11.0668 13.7268 16.7858 20.3037 0.1142 0.0904 0.0729 0.0596 0.0493 3.7845 4.1604 4.4873 4.7716 5.0188 0.2642 0.2404 0.2229 0.2096 0.1993 11 12 13 14 15 4.6524 5.3503 6.1528 7.0757 8.1371 0.2149 0.1869 0.1625 0.1413 0.1229 24.3493 29.0017 34.3519 40.5047 47.5804 0.0411 0.0345 0.0291 0.0247 0.0210 5.2337 5.4206 5.5831 5.7245 5.8474 0.1911 0.1845 0.1791 0.1747 0.1710 Enter your answer in the answer box

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts