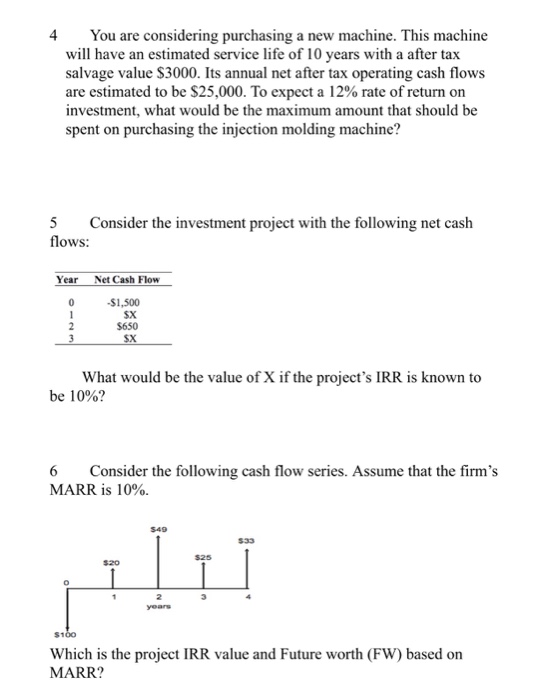

Question: You are considering purchasing a new machine. This machine will have an estimated service life of 10 years with a after tax salvage value $3000.

You are considering purchasing a new machine. This machine will have an estimated service life of 10 years with a after tax salvage value $3000. Its annual net after tax operating cash flows are estimated to be $25,000. To expect a 12% rate of return on investment, what would be the maximum amount that should be spent on purchasing the injection molding machine? Consider the investment project with the following net cash flows: What would be the value of X if the project's IRR is known to be 10%? Consider the following cash flow series. Assume that the firm's MARR is 10%. Which is the project IRR value and Future worth (FW) based on MARR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts