Question: You are considering purchasing a restaurant. The current income statement (2019) is presented below. Anticipating a drop off of sales after the change in ownership,

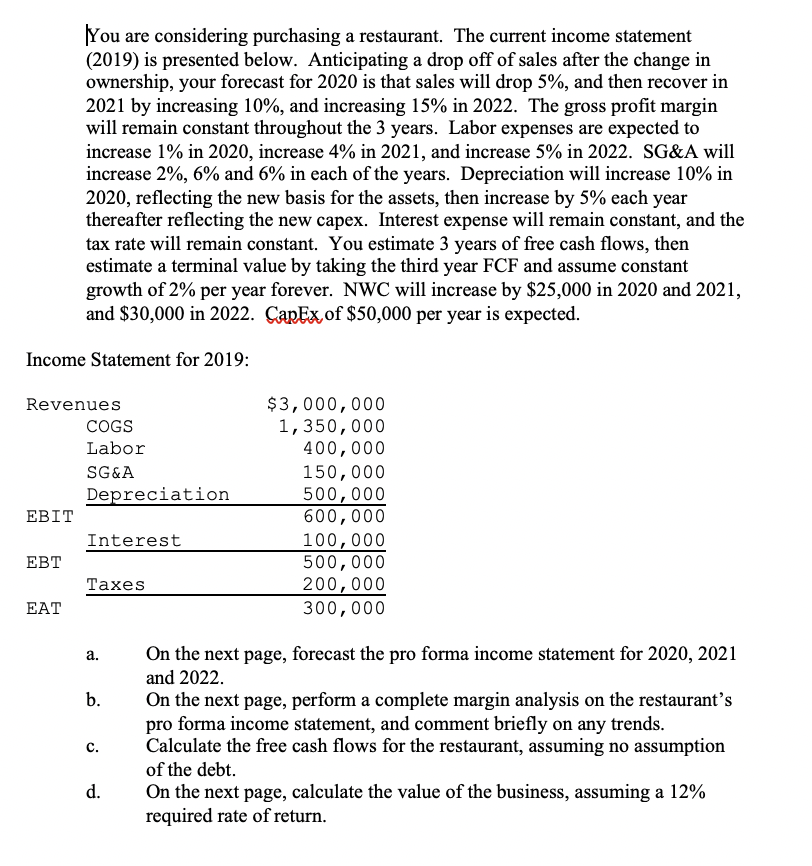

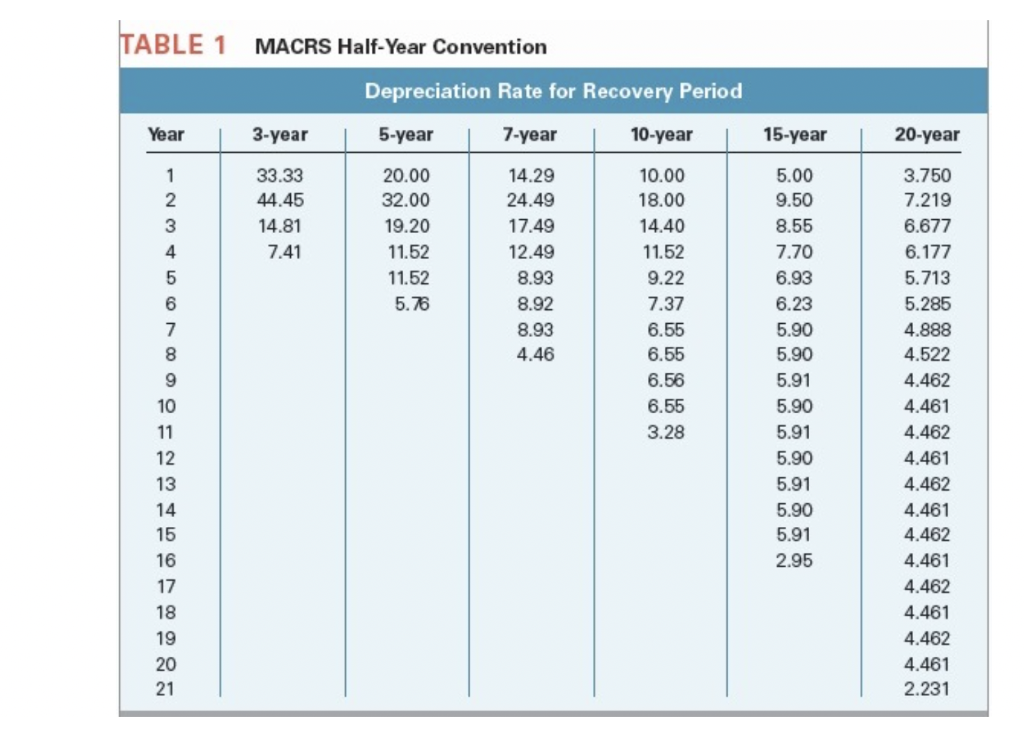

You are considering purchasing a restaurant. The current income statement (2019) is presented below. Anticipating a drop off of sales after the change in ownership, your forecast for 2020 is that sales will drop 5%, and then recover in 2021 by increasing 10%, and increasing 15% in 2022. The gross profit margin will remain constant throughout the 3 years. Labor expenses are expected to increase 1% in 2020, increase 4% in 2021, and increase 5% in 2022. SG&A will increase 2%, 6% and 6% in each of the years. Depreciation will increase 10% in 2020, reflecting the new basis for the assets, then increase by 5% each year thereafter reflecting the new capex. Interest expense will remain constant, and the tax rate will remain constant. You estimate 3 years of free cash flows, then estimate a terminal value by taking the third year FCF and assume constant growth of 2% per year forever. NWC will increase by $25,000 in 2020 and 2021, and $30,000 in 2022. CapEx of $50,000 per year is expected. Income Statement for 2019: Revenues COGS Labor SG&A Depreciation EBIT Interest Taxes EAT $3,000,000 1,350,000 400,000 150,000 500,000 600,000 100,000 500,000 200,000 300,000 On the next page, forecast the pro forma income statement for 2020, 2021 and 2022. On the next page, perform a complete margin analysis on the restaurant's pro forma income statement, and comment briefly on any trends. Calculate the free cash flows for the restaurant, assuming no assumption of the debt. On the next page, calculate the value of the business, assuming a 12% required rate of return. TABLE 1 MACRS Half-Year Convention Depreciation Rate for Recovery Period Year 3-year 5-year 7-year 10-year 15-year 20-year 33.33 44.45 14.81 7.41 20.00 32.00 19.20 11.52 11.52 5.76 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 10.00 18.00 14.40 11.52 9.22 7.37 6.55 5.00 9.50 8.55 7.70 6.93 6.23 5.90 6.55 6.56 6.55 3.28 NOGO GOWN- 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 You are considering purchasing a restaurant. The current income statement (2019) is presented below. Anticipating a drop off of sales after the change in ownership, your forecast for 2020 is that sales will drop 5%, and then recover in 2021 by increasing 10%, and increasing 15% in 2022. The gross profit margin will remain constant throughout the 3 years. Labor expenses are expected to increase 1% in 2020, increase 4% in 2021, and increase 5% in 2022. SG&A will increase 2%, 6% and 6% in each of the years. Depreciation will increase 10% in 2020, reflecting the new basis for the assets, then increase by 5% each year thereafter reflecting the new capex. Interest expense will remain constant, and the tax rate will remain constant. You estimate 3 years of free cash flows, then estimate a terminal value by taking the third year FCF and assume constant growth of 2% per year forever. NWC will increase by $25,000 in 2020 and 2021, and $30,000 in 2022. CapEx of $50,000 per year is expected. Income Statement for 2019: Revenues COGS Labor SG&A Depreciation EBIT Interest Taxes EAT $3,000,000 1,350,000 400,000 150,000 500,000 600,000 100,000 500,000 200,000 300,000 On the next page, forecast the pro forma income statement for 2020, 2021 and 2022. On the next page, perform a complete margin analysis on the restaurant's pro forma income statement, and comment briefly on any trends. Calculate the free cash flows for the restaurant, assuming no assumption of the debt. On the next page, calculate the value of the business, assuming a 12% required rate of return. TABLE 1 MACRS Half-Year Convention Depreciation Rate for Recovery Period Year 3-year 5-year 7-year 10-year 15-year 20-year 33.33 44.45 14.81 7.41 20.00 32.00 19.20 11.52 11.52 5.76 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 10.00 18.00 14.40 11.52 9.22 7.37 6.55 5.00 9.50 8.55 7.70 6.93 6.23 5.90 6.55 6.56 6.55 3.28 NOGO GOWN- 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts