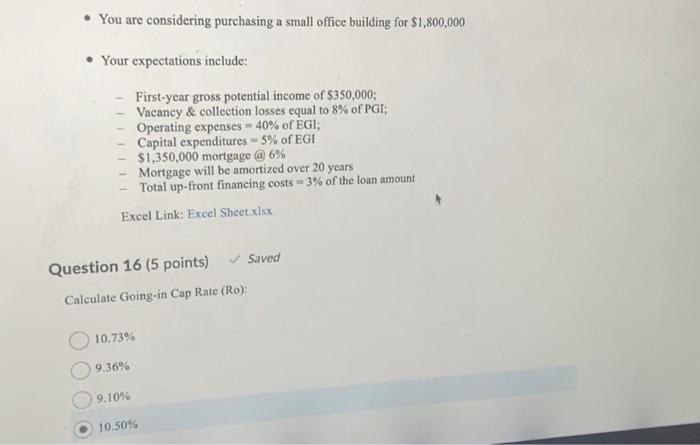

Question: - You are considering purchasing a small office building for $1,800,000 - Your expectations include: - First-year gross potential income of $350,000; - Vacancy &

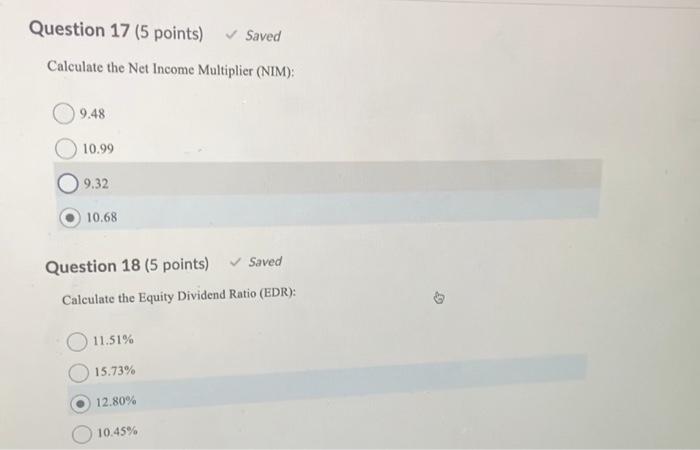

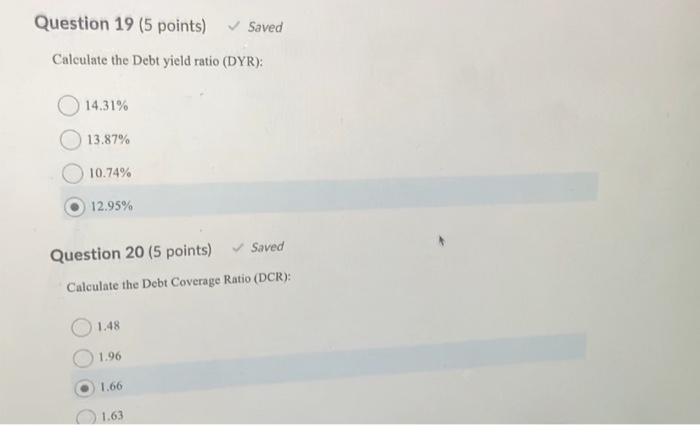

- You are considering purchasing a small office building for $1,800,000 - Your expectations include: - First-year gross potential income of $350,000; - Vacancy \& collection losses equal to 8% of PGI; - Operating expenses =40% of EGI; - Capital expenditures =5% of EGI - $1,350,000 mortgage (a) 6\% - Mortgage will be amortized over 20 years - Total up-front financing costs =3% of the loan amount Excel Link: Excel Sheet.xlsx Question 16 (5 points) Saved Calculate Going-in Cap Rate (Ro): 10.73% 9.36% 9.10% 10.50% Calculate the Net Income Multiplier (NIM): 9.48 10.99 9.32 10.68 Question 18 (5 points) Saved Calculate the Equity Dividend Ratio (EDR): 11.51% 15.73% 12.80% 10.45% Calculate the Debt yield ratio (DYR): 14.31% 13.87% 10.74% 12.95% Question 20 (5 points) Saved Calculate the Debt Coverage Ratio (DCR): 1.48 1.96 1.66 1.63 - You are considering purchasing a small office building for $1,800,000 - Your expectations include: - First-year gross potential income of $350,000; - Vacancy \& collection losses equal to 8% of PGI; - Operating expenses =40% of EGI; - Capital expenditures =5% of EGI - $1,350,000 mortgage (a) 6\% - Mortgage will be amortized over 20 years - Total up-front financing costs =3% of the loan amount Excel Link: Excel Sheet.xlsx Question 16 (5 points) Saved Calculate Going-in Cap Rate (Ro): 10.73% 9.36% 9.10% 10.50% Calculate the Net Income Multiplier (NIM): 9.48 10.99 9.32 10.68 Question 18 (5 points) Saved Calculate the Equity Dividend Ratio (EDR): 11.51% 15.73% 12.80% 10.45% Calculate the Debt yield ratio (DYR): 14.31% 13.87% 10.74% 12.95% Question 20 (5 points) Saved Calculate the Debt Coverage Ratio (DCR): 1.48 1.96 1.66 1.63

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts