Question: You are considering replacing an old, inefficient machine that was purchased four years ago at a cost of $10,000. The old machine had an original

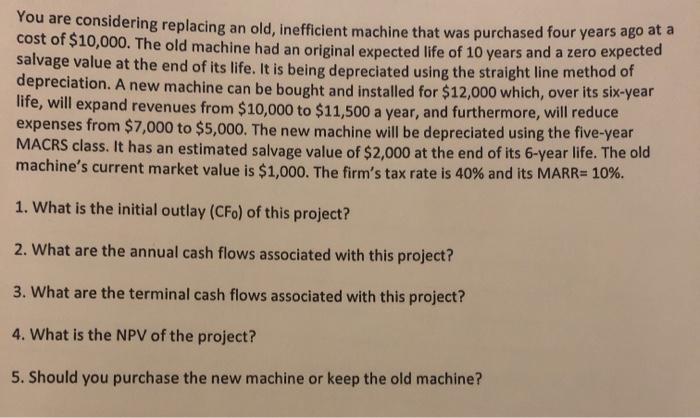

You are considering replacing an old, inefficient machine that was purchased four years ago at a cost of $10,000. The old machine had an original expected life of 10 years and a zero expected salvage value at the end of its life. It is being depreciated using the straight line method of depreciation. A new machine can be bought and installed for $12,000 which, over its six-year life, will expand revenues from $10,000 to $11,500 a year, and furthermore, will reduce expenses from $7,000 to $5,000. The new machine will be depreciated using the five-year MACRS class. It has an estimated salvage value of $2,000 at the end of its 6-year life. The old machine's current market value is $1,000. The firm's tax rate is 40% and its MARR= 10%. 1. What is the initial outlay (CFo) of this project? 2. What are the annual cash flows associated with this project? 3. What are the terminal cash flows associated with this project? 4. What is the NPV of the project? 5. Should you purchase the new machine or keep the old machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts