Question: You are considering replacing an old machine which was purchased 5 years ago at $150,000. The old machine is still working and has five more

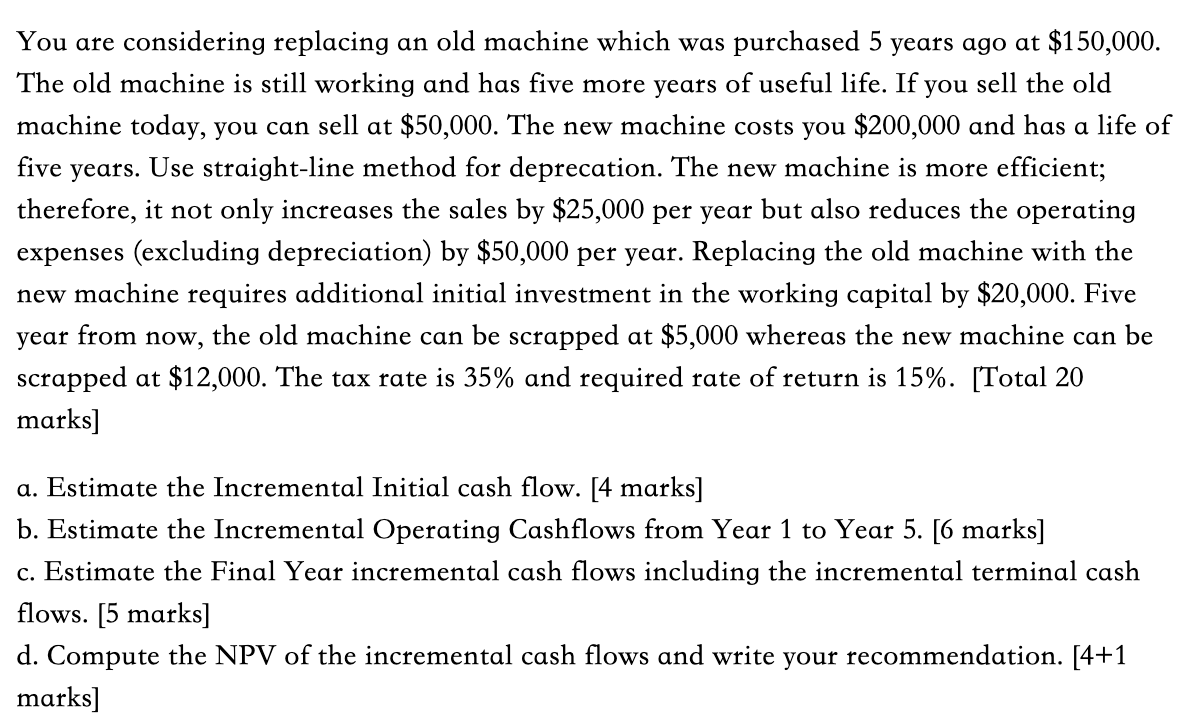

You are considering replacing an old machine which was purchased 5 years ago at $150,000. The old machine is still working and has five more years of useful life. If you sell the old machine today, you can sell at $50,000. The new machine costs you $200,000 and has a life of five years. Use straight-line method for deprecation. The new machine is more efficient; therefore, it not only increases the sales by $25,000 per year but also reduces the operating expenses (excluding depreciation) by $50,000 per year. Replacing the old machine with the new machine requires additional initial investment in the working capital by $20,000. Five year from the old machine can be scrapped at $5,000 whereas the new machine can be scrapped at $12,000. The tax rate is 35% and required rate of return is 15%. [Total 20 marks] now, a. Estimate the Incremental Initial cash flow. [4 marks] b. Estimate the Incremental Operating Cashflows from Year 1 to Year 5. [6 marks] c. Estimate the Final Year incremental cash flows including the incremental terminal cash flows. [5 marks] d. Compute the NPV of the incremental cash flows and write your recommendation. [4+1 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts