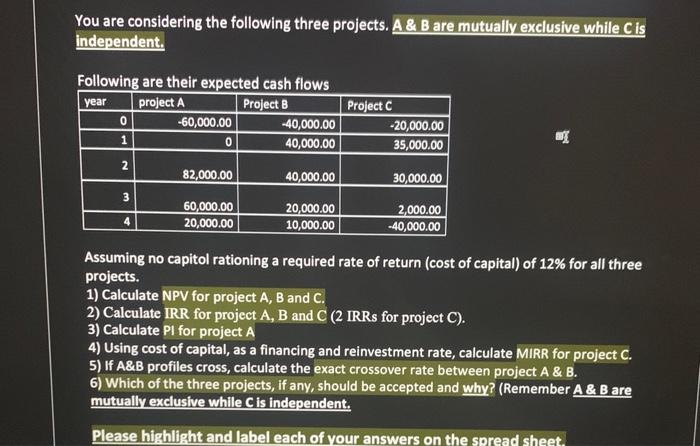

Question: You are considering the following three projects. A & B are mutually exclusive while C is independent. year Following are their expected cash flows project

You are considering the following three projects. A & B are mutually exclusive while C is independent. year Following are their expected cash flows project A Project B 0 -60,000.00 -40,000.00 40,000.00 Project C -20,000.00 35,000.00 1 0 2 82,000.00 40,000.00 30,000.00 3 60,000.00 20,000.00 4 20,000.00 10,000.00 2,000.00 - 40,000.00 Assuming no capitol rationing a required rate of return (cost of capital) of 12% for all three projects. 1) Calculate NPV for project A, B and C. 2) Calculate IRR for project A, B and C (2 IRRs for project C). 3) Calculate PI for project A 4) Using cost of capital, as a financing and reinvestment rate, calculate MIRR for project C. 5) If A&B profiles cross, calculate the exact crossover rate between project A & B. 6) Which of the three projects, if any, should be accepted and why? (Remember A & B are mutually exclusive while C is independent Please highlight and label each of your answers on the spread sheet. Assuming no capitol rationing a required rate of return (cost of capital) of 12% for projects. 1) Calculate NPV for project A, B and C. 2) Calculate IRR for project A, B and C (2 IRRs for project C). 3) Calculate Pl for project A 4) Using cost of capital, as a financing and reinvestment rate, calculate MIRR for pre 5) If A&B profiles cross, calculate the exact crossover rate between project A & B. 6) Which of the three projects, if any, should be accepted and why? (Remember A & mutually exclusive while C is independent. Please highlight and label each of your answers on the spread sheet. Format all your answers to show 2 decimal places. M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts