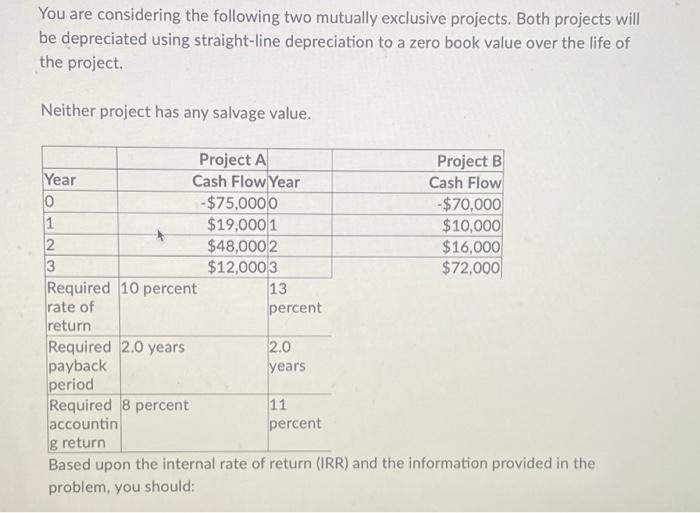

Question: You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life

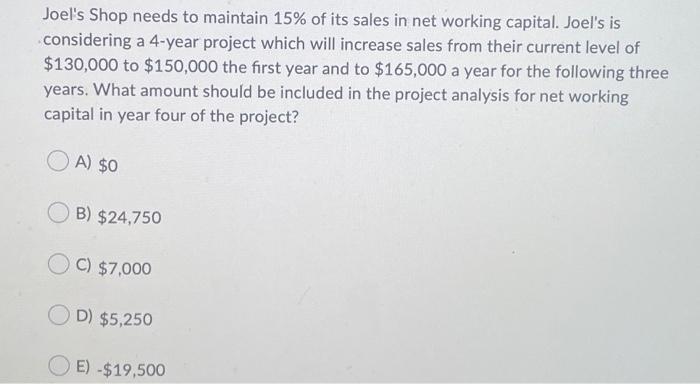

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project Neither project has any salvage value. Project A Project B Year Cash Flow Year Cash Flow 0 - $75,0000 -$70,000 1 $19,000 1 $10,000 2 $48,000 2 $ 16,000 3 $12,000 3 $72,000 Required 10 percent 13 rate of percent return Required 2.0 years 2.0 payback years period Required 8 percent 11 accountin percent g return Based upon the internal rate of return (IRR) and the information provided in the problem, you should: O A) accept both project A and project B. B) accept project B and reject project A. C) accept project A and reject project B. D) reject both project A and project B. E) Ignore the IRR rule and use another method of analysis. Joel's Shop needs to maintain 15% of its sales in net working capital. Joel's is considering a 4-year project which will increase sales from their current level of $130,000 to $150,000 the first year and to $165,000 a year for the following three years. What amount should be included in the project analysis for net working capital in year four of the project? A) $0 B) $24,750 OC) $7,000 D) $5,250 E) -$19,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts