Question: You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life

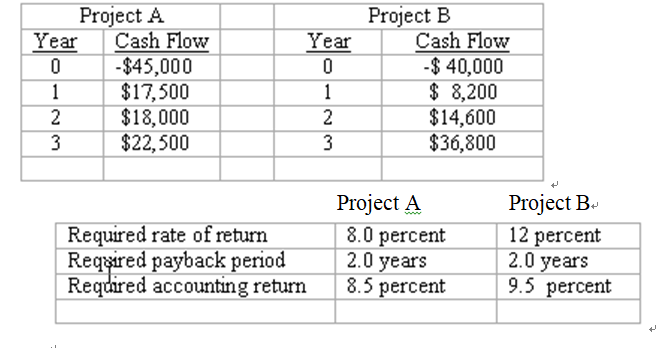

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

Show detailed work

What is the IRR for each of the projects? Which project should be accepted if IRR method is applied? Explain why.

What is the discounted payback period for each of the projects? Which project should be accepted if discounted payback period method is applied? Explain why.

Year Project A Year Cash Flow -$45,000 $17,500 $18,000 $22,500 Project B Cash Flow -$ 40,000 $ 8,200 $14,600 $36,800 Required rate of return Required payback period Required accounting return Project A 8.0 percent 2.0 years 8.5 percent Project B- 12 percent 2.0 years 9.5 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts