Question: You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life

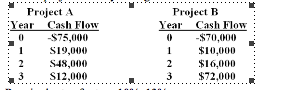

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

Required rate of return 10%, 13% Required payback period 2.0 years, 2.0 years

Based on the net present value method of analysis and given the information in the problem, you should: A. accept both project A and project B. B. accept project A and reject project B. C. accept project B and reject project A. D. reject both project A and project B. E. accept whichever one you want as they represent equal opportunities.

please show work

Project A Year Cash Flow $75,000 S19,000 S48,000 3 S12,000 Project B Year Cash Flow 0 -$70,000 $10,000 2 $16,000 3 $72,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts