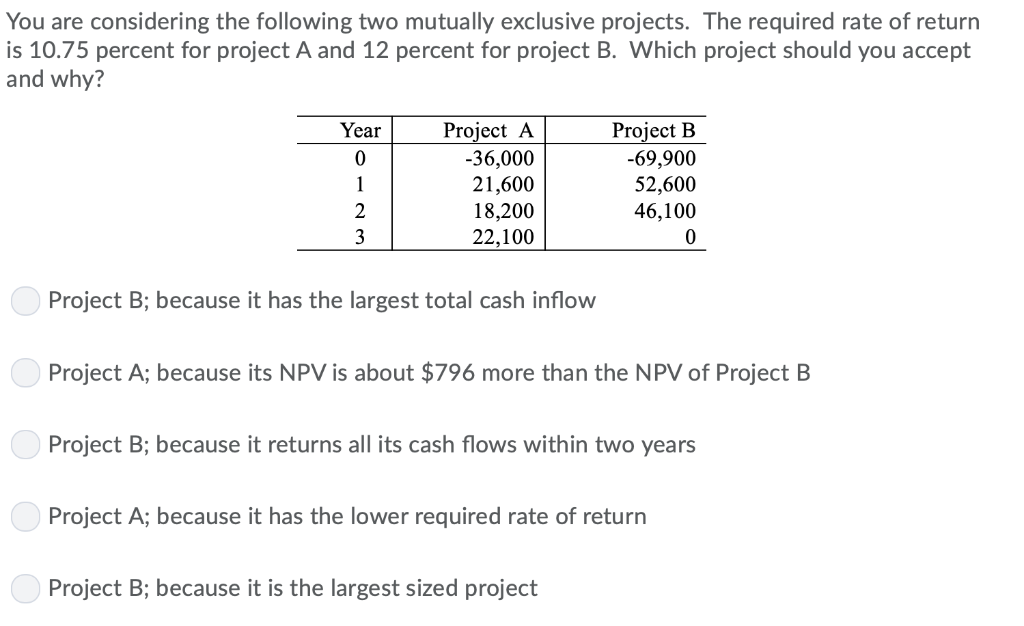

Question: You are considering the following two mutually exclusive projects. The required rate of return is 10.75 percent for project A and 12 percent for project

You are considering the following two mutually exclusive projects. The required rate of return is 10.75 percent for project A and 12 percent for project B. Which project should you accept and why? Project A -36,000 21,600 18,200 22,100 Project B -69,900 52,600 46,100 Year 1 2 3 0 Project B; because it has the largest total cash inflow Project A; because its NPV is about $796 more than the NPV of Project B Project B; because it returns all its cash flows within two years Project A; because it has the lower required rate of return Project B; because it is the largest sized project From a cash flow position, which of the following ratios best measures a firm's ability to pay the interest on its debts? Acid test ratio Average collection period Equity multiplier Times interest earned ratio Total debt ratio Higher is always better for which of the following ratios? Profit margin Debt-to-equity ratio Return on Assets (ROA) A and C only All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts