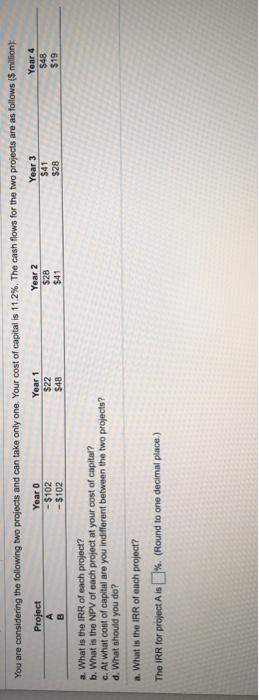

Question: You are considering the following two projects and can take only one. Your cost of capital is 11.2%. The cash flows for the two projects

You are considering the following two projects and can take only one. Your cost of capital is 11.2%. The cash flows for the two projects are as follows ($ million Project Year 0 Year 1 Year 2 Year 3 Year 4 - $102 $22 $28 $41 $48 B - $102 $48 $41 $19 $28 a. What is the IRR of each project? b. What is the NPV of each project at your cost of capital? c. At what cost of capital are you indifferent between the two projects? d. What should you do? a. What is the IRR of each project? The IRR for project As % (Round to one decimal place)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts