Question: You are considering the purchase of a new machine for a project. Details of this potential purchase are provided below. The project life is

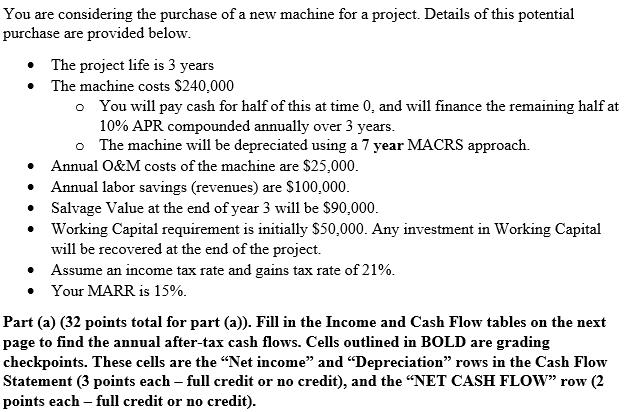

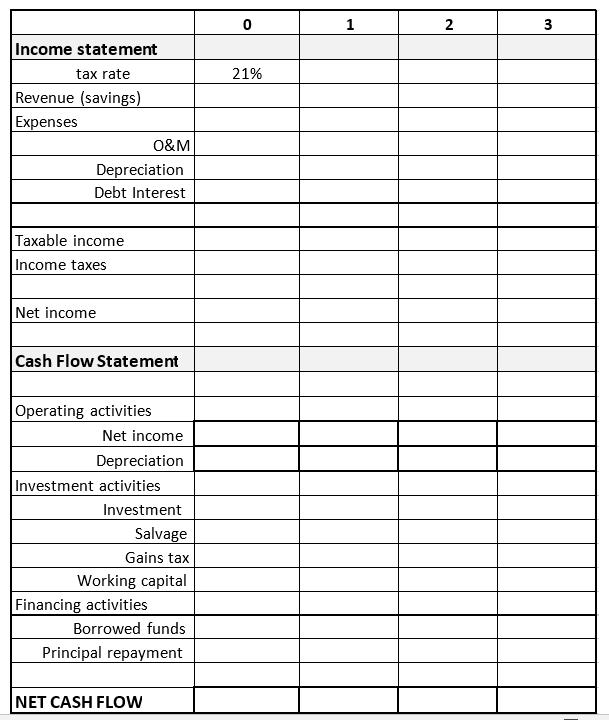

You are considering the purchase of a new machine for a project. Details of this potential purchase are provided below. The project life is 3 years The machine costs $240,000 o You will pay cash for half of this at time 0, and will finance the remaining half at 10% APR compounded annually over 3 years. o The machine will be depreciated using a 7 year MACRS approach. Annual O&M costs of the machine are $25,000. Annual labor savings (revenues) are $100,000. Salvage Value at the end of year 3 will be $90,000. Working Capital requirement is initially $50,000. Any investment in Working Capital will be recovered at the end of the project. Assume an income tax rate and gains tax rate of 21%. Your MARR is 15%. Part (a) (32 points total for part (a)). Fill in the Income and Cash Flow tables on the next page to find the annual after-tax cash flows. Cells outlined in BOLD are grading checkpoints. These cells are the "Net income" and "Depreciation" rows in the Cash Flow Statement (3 points each full credit or no credit), and the "NET CASH FLOW" row (2 points each full credit or no credit). 1 2 3 Income statement tax rate 21% Revenue (savings) Expenses O&M Depreciation Debt Interest Taxable income Income taxes Net income Cash Flow Statement Operating activities Net income Depreciation Investment activities Investment Salvage Gains tax Working capital Financing activities Borrowed funds Principal repayment NET CASH FLOW

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts