Question: You are considering two assets with the following characteristics. E ( R 1 ) = 0.15 E ( 1 ) = 0.09 w 1 =

You are considering two assets with the following characteristics.

| E(R1) = 0.15 | E(1) = 0.09 | w1 = 0.3 |

| E(R2) = 0.22 | E(2) = 0.19 | w2 = 0.7 |

Compute the mean and standard deviation of two portfolios if r1,2 = 0.50 and -0.70, respectively. Do not round intermediate calculations. Round your answers for the mean of two portfolios to three decimal places and answers for standard deviations of two portfolios to five decimal places.

Mean of two portfolios:

Standard deviation of two portfolios if r1,2 = 0.50:

Standard deviation of two portfolios if r1,2 = -0.70:

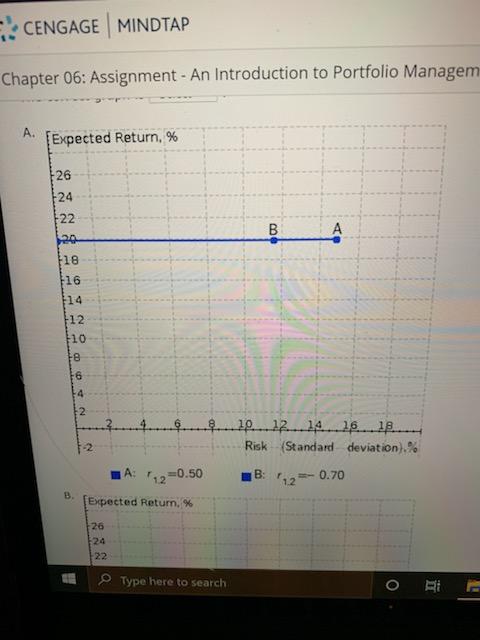

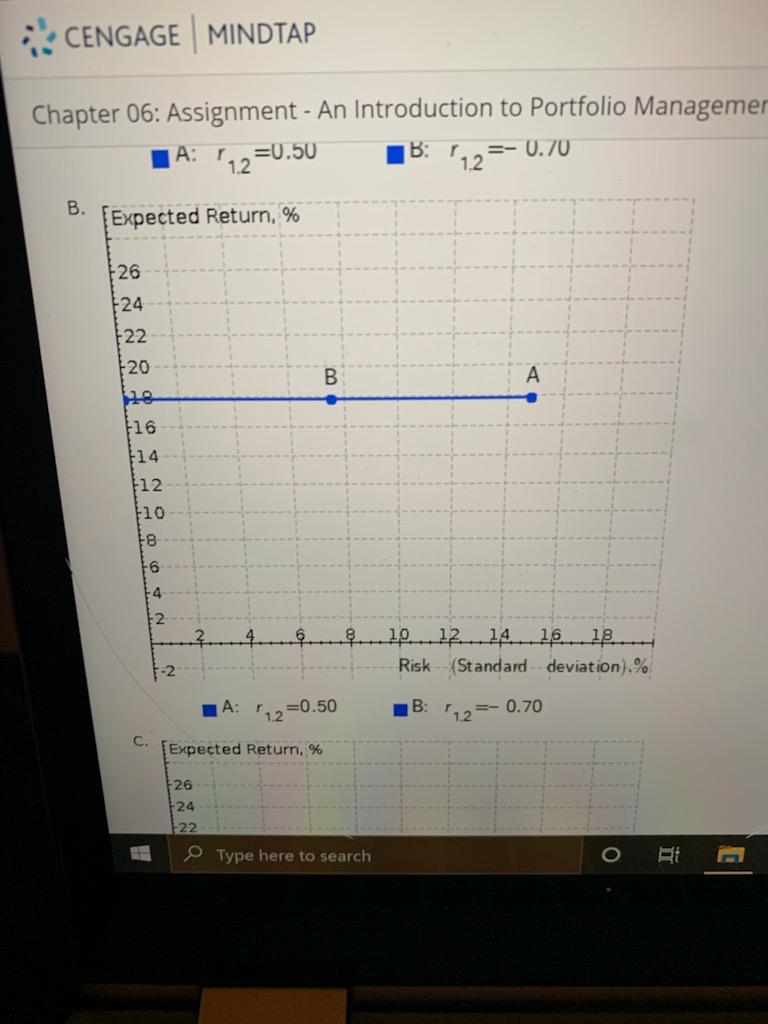

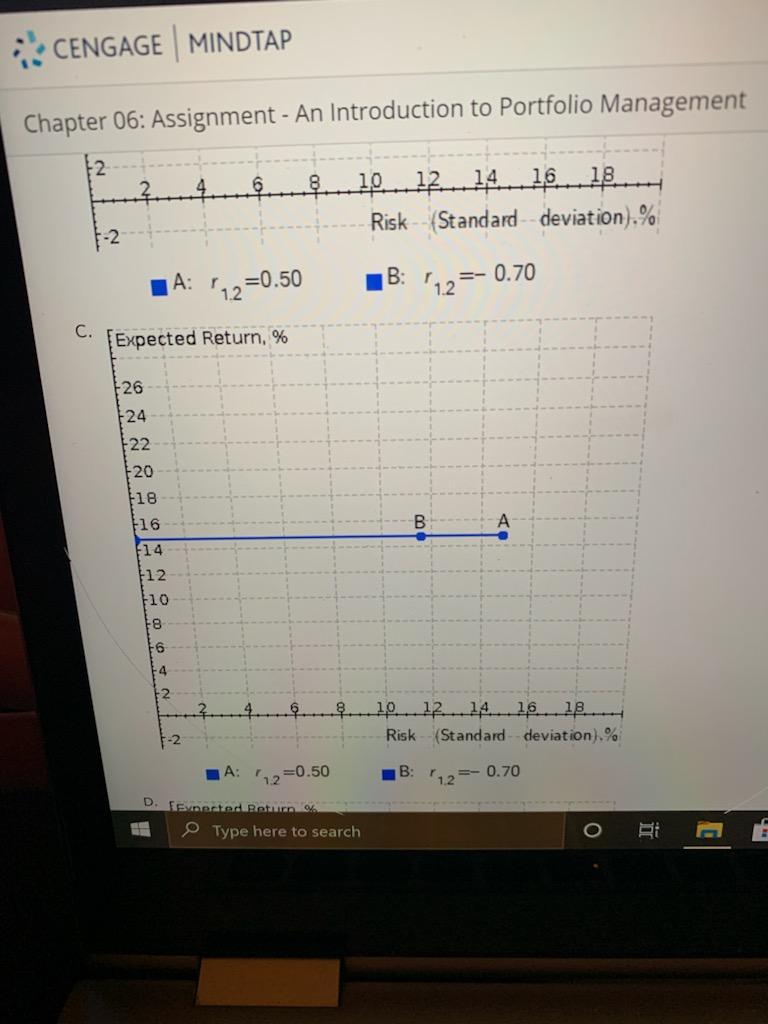

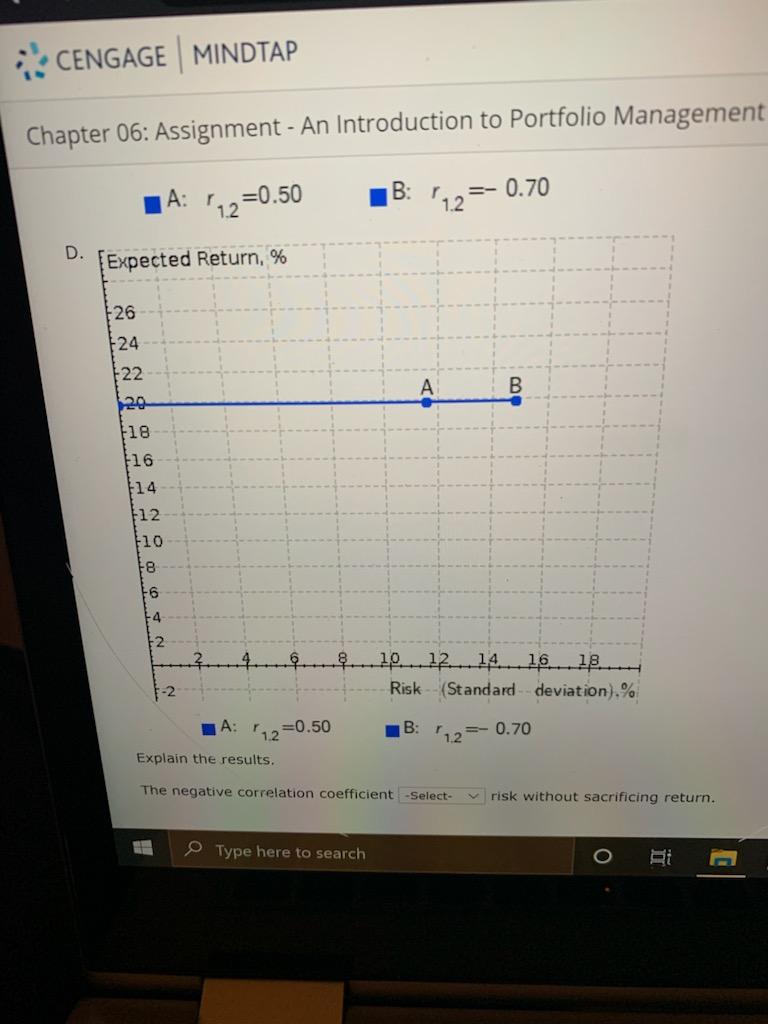

Choose the correct riskreturn graph.

The correct graph is -Select-

F: CENGAGE MINDTAP Chapter 06: Assignment - An Introduction to Portfolio Managem A. Expected Return. % 26 124 +22 20 F18 B F16 114 12 10 Fe 16 10.12.14.16.... 18 Risk (Standard deviation).% IA B: 12=0.50 - 0.70 B Expected Return% 25 24 22 Type here to search CENGAGE MINDTAP Chapter 06: Assignment - An Introduction to Portfolio Managemer A: 11.25 =0.50 =- 0.70 B: '12 B. Expected Return, % 26 24 22 20 B A 16 14 12 F10 18 6 4 2 10.12. 14. 15. 12. Risk (Standard deviation) % 2 A: 1.2=0.50 B: 12=-0.70 C. Expected Return. % 26 24 22 Type here to search o CENGAGE MINDTAP Chapter 06: Assignment - An Introduction to Portfolio Management 10 12 14 16 18 Risk (Standard deviation).% B: A: '12=0.50 '12--0.70 C. Expected Return, % 26 124 22 20 118 116 114 F12 110 8 16 4 2 10.12.14.16.12. Risk - (Standard deviation).% A: 12 =0.50 B: 112 - 0.70 D synorted Botanno Type here to search O RE CENGAGE MINDTAP Chapter 06: Assignment - An Introduction to Portfolio Management A: 1 B: =-0.70 '12=0.50 D. [Expected Return, % +26 24 22 A B 118 116 114 412 10 FB 16 4 2 10... 12... 14.16 18. Risk (Standard deviation).% B: A: 12 =0.50 Explain the results. 12 - 0.70 The negative correlation coefficient -Select- risk without sacrificing return. Type here to search o Bi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts