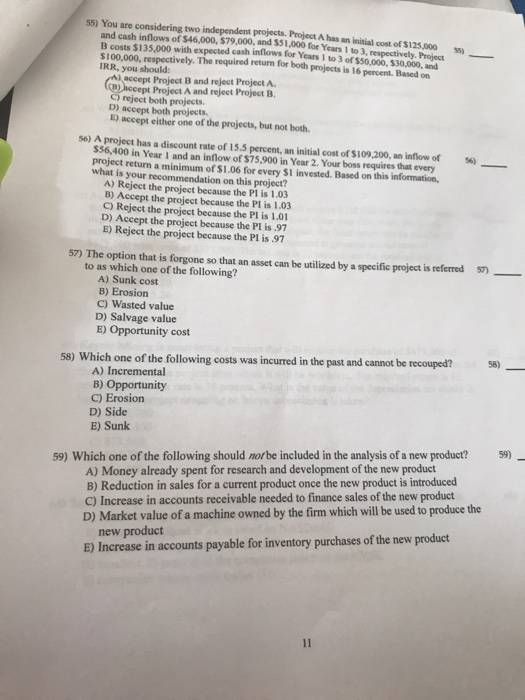

Question: You are considering two independent projects. Project A has an initial cost of $125,000 5 and cash inflows of $46,000, $79,000, and $51.000 for Years

You are considering two independent projects. Project A has an initial cost of $125,000 5 and cash inflows of $46,000, $79,000, and $51.000 for Years I to 3, reapectively Project B costs $135,000 with expected cash inflows for Years 1 to 3 of s100,000, respectively. The required return for both projects is 16 percent. Based on IRR, you should: accept Project B and reject Project A. B) hccept Project A and reject Project B. C) reject both projects D) accept both projects E) accept either one of the projects, but not both. $50,000, 530,000, and 56) A project has a discount rate of 15.5 percent, an initial cost of $109.200, an inflow of 5$6,400 in Year I and an inflow of $75,900 in Year 2. Your boss requires that every project return a minimum of $1.06 for every $1 invested. Based on this information what is your recommendation on this project? A) Reject the project because the Pl is 1.03 B) Accept the project because the PI is 1.03 C) Reject the project because the PI is 1.01 D) Accept the project because the PI is.97 E) Reject the project because the Pl is 97 57) The option that is forgone so that an asset can be utilized by a specific project is referred 57) to as which one of the following? A) Sunk cost B) Erosion C) Wasted value D) Salvage value E) Opportunity cost 58) Which one of the following costs was incurred in the past and cannot be recouped? A) Incremental B) Opportunity C) Erosion D) Side E) Sunk 59) Which one of the following should notbe included in the analysis of a new product? 9) A) Money already spent for research and development of the new product B) Reduction in sales for a current product once the new product is introduced C) Increase in accounts receivable needed to finance sales of the new product D) Market value of a machine owned by the firm which will be used to produce the new product E) Increase in accounts payable for inventory purchases of the new product

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts