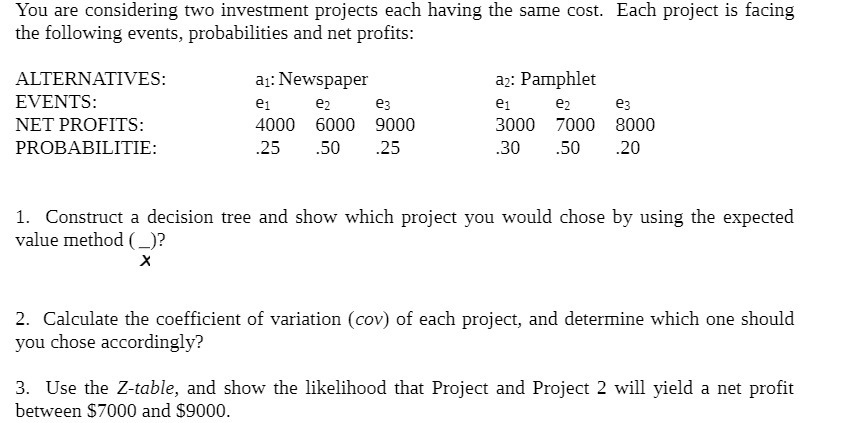

Question: You are considering two investment projects each having the same cost. Each project is facing the following events, probabilities and net profits: ALTERNATIVES: a1: Newspaper

You are considering two investment projects each having the same cost. Each project is facing the following events, probabilities and net profits: ALTERNATIVES: a1: Newspaper a2: Pamphlet EVENTS: e1 e2 e3 e1 e2 e3 NET PROFITS: 4000 6000 9000 3000 2000 8000 PROBABILITIE: .25 .50 .25 .30 .50 .20 1. Consu'uct a decision tree and show which project you would chose by using the expected value method (_)? X 2. Calculate the coefficient of variation (GOV) of each project, and determine which one should you chose accordingly? 3. Use the Ztuble, and Show the likelihood that Project and Project 2 will yield a net prot between $2000 and $9000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts