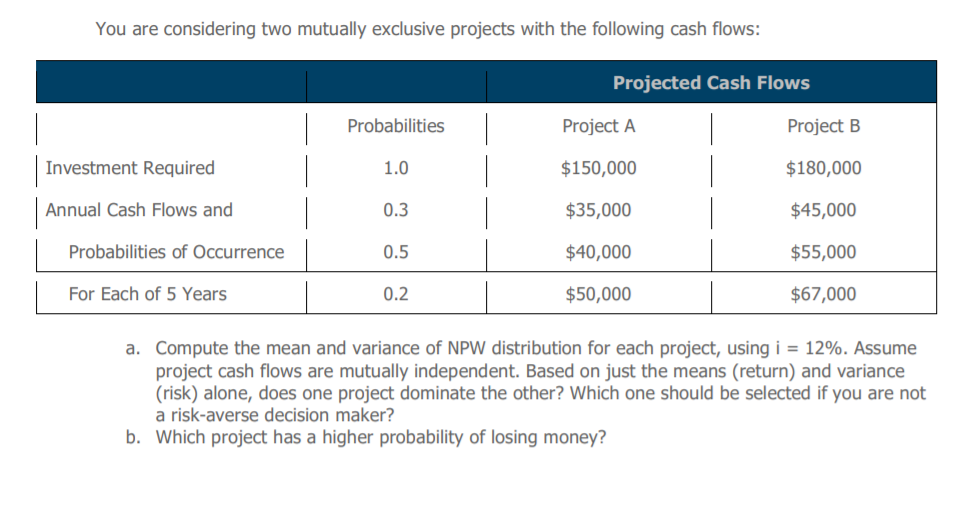

Question: You are considering two mutually exclusive projects with the following cash flows: Projected Cash Flows Probabilities Project A Project B Investment Required $150,000 $180,000 1.0

You are considering two mutually exclusive projects with the following cash flows: Projected Cash Flows Probabilities Project A Project B Investment Required $150,000 $180,000 1.0 Annual Cash Flows and $35,000 $45,000 0.3 Probabilities of Occurrence $40,000 $55,000 0.5 For Each of 5 Years $67,000 0.2 $50,000 a. Compute the mean and variance of NPW distribution for each project, using i = 12%. Assume project cash flows are mutually independent. Based on just the means (return) and variance (risk) alone, does one project dominate the other? Which one should be selected if you are not a risk-averse decision maker? b. Which project has a higher probability of losing money? You are considering two mutually exclusive projects with the following cash flows: Projected Cash Flows Probabilities Project A Project B Investment Required $150,000 $180,000 1.0 Annual Cash Flows and $35,000 $45,000 0.3 Probabilities of Occurrence $40,000 $55,000 0.5 For Each of 5 Years $67,000 0.2 $50,000 a. Compute the mean and variance of NPW distribution for each project, using i = 12%. Assume project cash flows are mutually independent. Based on just the means (return) and variance (risk) alone, does one project dominate the other? Which one should be selected if you are not a risk-averse decision maker? b. Which project has a higher probability of losing money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts