Question: You are considering two mutually exclusive projects with the following after-tax cash-flows. We have to select only one project. When your company's cost of capital

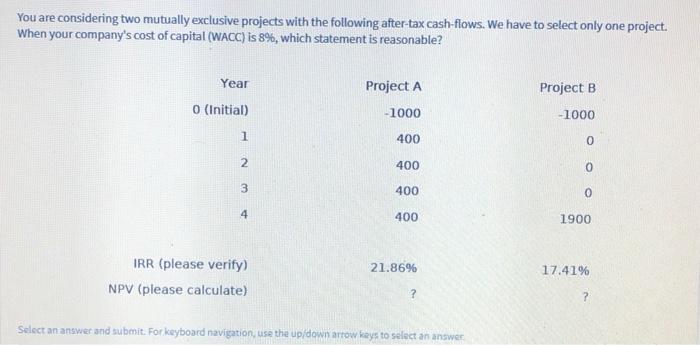

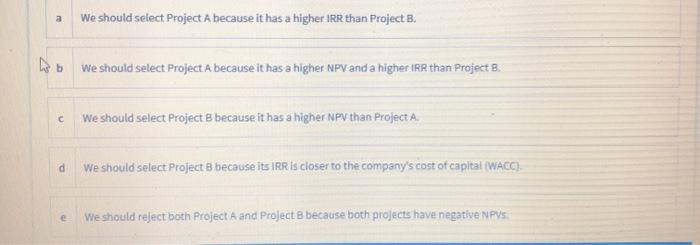

You are considering two mutually exclusive projects with the following after-tax cash-flows. We have to select only one project. When your company's cost of capital (WACC) is 8%, which statement is reasonable? Year Project A Project B O (Initial) -1000 -1000 1 400 0 2 400 0 3 400 0 4 400 1900 21.86% IRR (please verify) NPV (please calculate) 17.41% ? ? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer a We should select Project A because it has a higher IRR than Project B. hasb we should select Project A because it has a higher NPV and a higher iR than Project B. We should select Project B because it has a higher NPV than Project A. d We should select Project B because its IRR is closer to the company's cost of capital (WACC). Weshould reject both Project A and Project B because both projects have negative NPVS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts