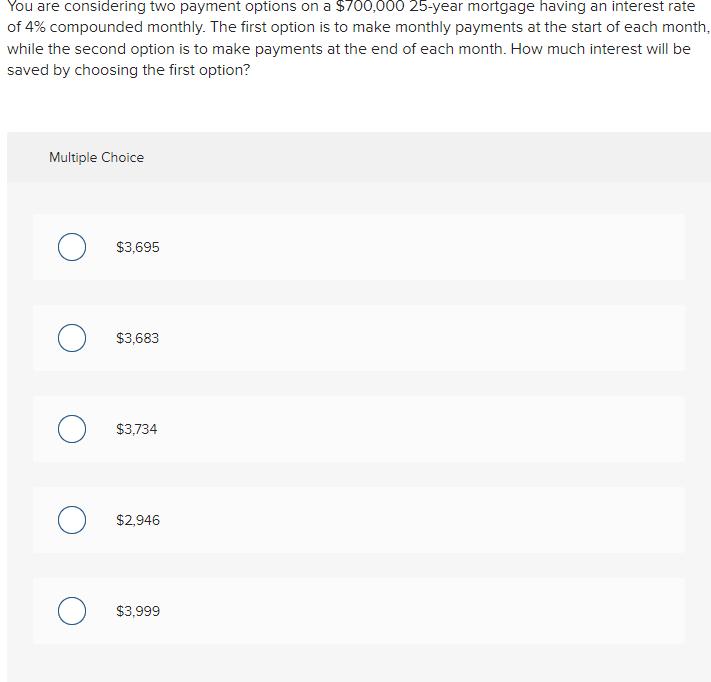

Question: You are considering two payment options on a $700,000 25-year mortgage having an interest rate of 4% compounded monthly. The first option is to

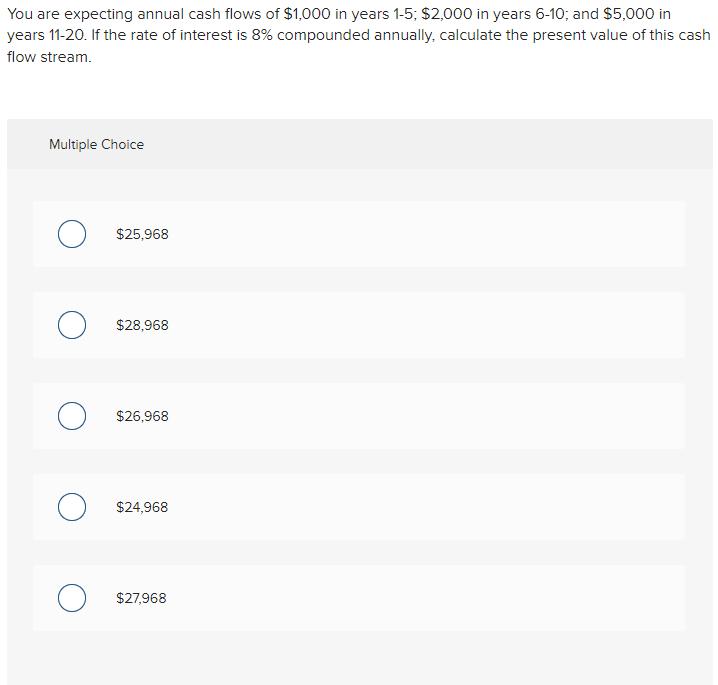

You are considering two payment options on a $700,000 25-year mortgage having an interest rate of 4% compounded monthly. The first option is to make monthly payments at the start of each month, while the second option is to make payments at the end of each month. How much interest will be saved by choosing the first option? Multiple Choice O $3,695 O $3,683 O $3,734 O $2,946 O $3,999 You are expecting annual cash flows of $1,000 in years 1-5; $2,000 in years 6-10; and $5,000 in years 11-20. If the rate of interest is 8% compounded annually, calculate the present value of this cash flow stream. Multiple Choice $25,968 O $28,968 O $26,968 O $24,968 O $27,968

Step by Step Solution

3.51 Rating (181 Votes )

There are 3 Steps involved in it

The detailed answer ... View full answer

Get step-by-step solutions from verified subject matter experts