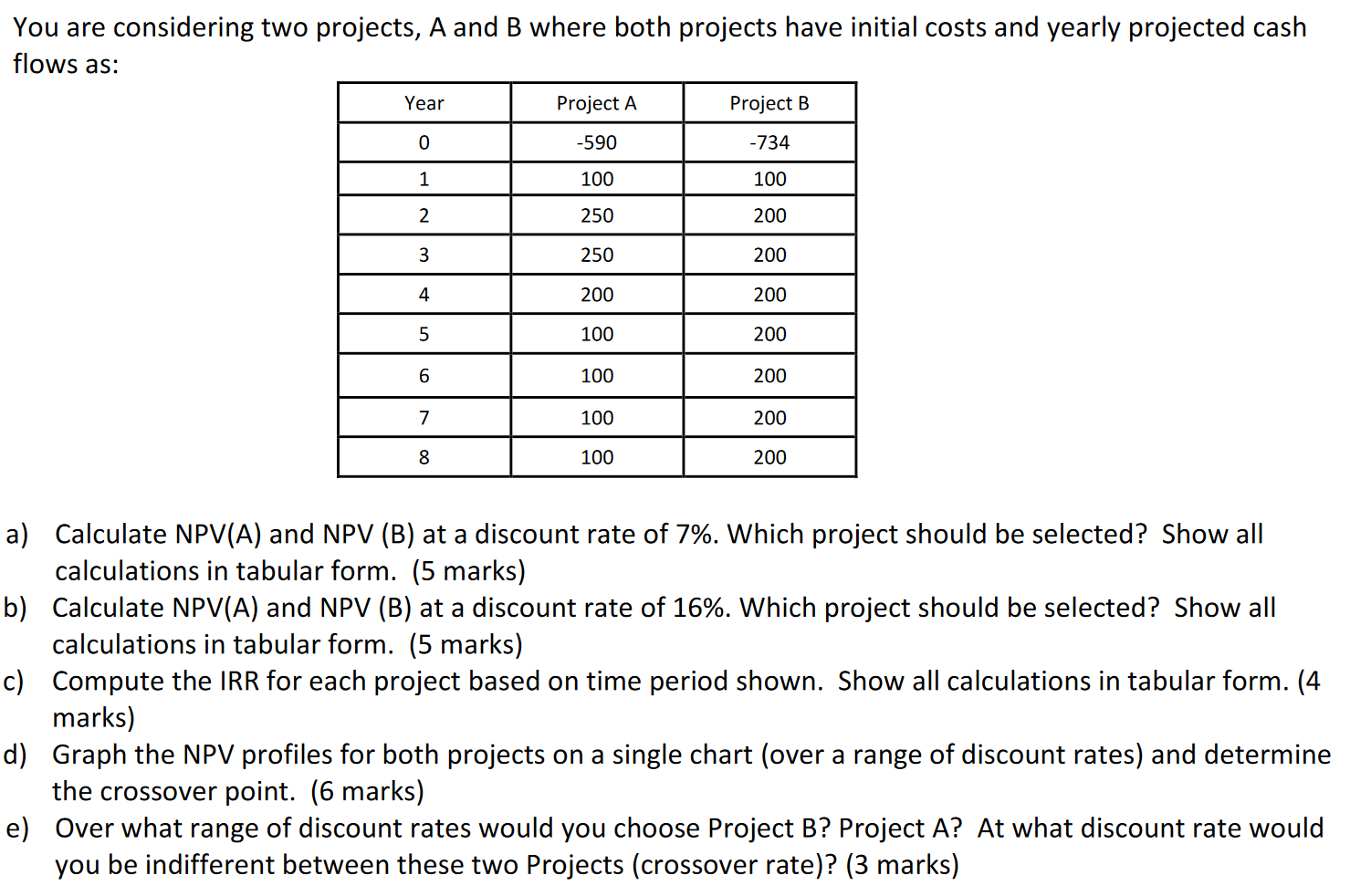

Question: You are considering two projects, A and B where both projects have initial costs and yearly projected cash flows as: Project A Project B Year

You are considering two projects, A and B where both projects have initial costs and yearly projected cash flows as: Project A Project B Year 0 -590 -734 1 100 100 2 250 200 3 250 200 4 200 200 5 100 200 6 100 200 7 100 200 8 100 200 a) Calculate NPV(A) and NPV (B) at a discount rate of 7%. Which project should be selected? Show all calculations in tabular form. (5 marks) b) Calculate NPV(A) and NPV (B) at a discount rate of 16%. Which project should be selected? Show all calculations in tabular form. (5 marks) c) Compute the IRR for each project based on time period shown. Show all calculations in tabular form. (4 marks) d) Graph the NPV profiles for both projects on a single chart (over a range of discount rates) and determine the crossover point. (6 marks) e) Over what range of discount rates would you choose Project B? Project A? At what discount rate would you be indifferent between these two Projects (crossover rate)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts